Market Analysis Review

Eurozone CPI flash confirming inflation cooling, OPEC+: voluntary production cuts Q1(2024), U.S. PCE down and jobless claims higher

Previous Trading Day’s Events (30 Nov 2023)

At least 1.3M bpd of those cuts, however, were an extension of voluntary curbs that Saudi Arabia and Russia already had in place.

“For now, the outcome does not live up to the expectation… in recent days,” said Callum MacPherson, head of commodities at Investec.

“From what we’ve seen so far, this looks like a paper cut of around 600-700,000 barrels per day (bpd) vs Q4 2023 planned levels,” said James Davis at FGE.

“It could at best be an actual cut of around 500,000 bpd compared to Q4. This might be just enough to keep the market balanced in Q1, but it will be close.”

OPEC+ also invited Brazil, a top 10 oil producer, to become a member of the group. The country’s energy minister said it hoped to join in January.

The labour market is gradually easing. More Americans applied for unemployment benefits last week and the number on jobless rolls surged to a two-year high in mid-November.

“The data this morning provide more ammunition for (Fed Chair Jerome) Powell and others at the Fed who are looking at an extended hold for policy, rather than an additional rate hike to curb inflation pressures,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York. “There is a hint that searches for a new job by recently laid-off individuals may be taking longer.”

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased 0.2% last month after an unrevised 0.7% gain in September.

Inflation-adjusted consumer spending rose 0.2% last month according to the PCE report. The Inflation report as measured by the personal consumption expenditures (PCE) price index was unchanged in October after rising 0.4% in September. In the 12 months through October, the PCE price index increased 3.0%. That was the smallest year-on-year gain since March 2021 and followed a 3.4% advance in September.

Source:

______________________________________________________________________

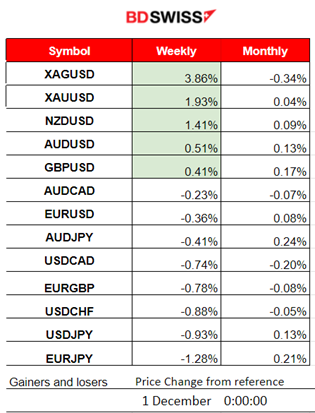

Winners vs Losers

______________________________________________________________________

______________________________________________________________________

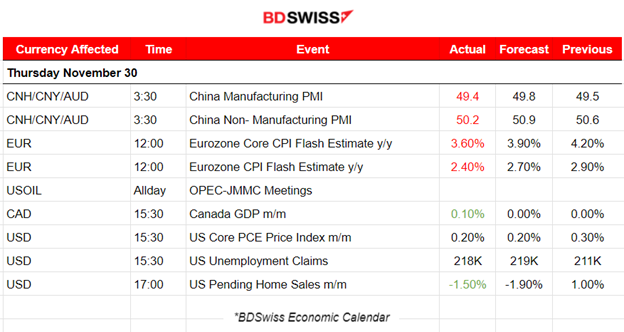

News Reports Monitor – Previous Trading Day (30 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

China’s Manufacturing PMI and Non-Manufacturing PMI were both reported lower than expected. No major shock was recorded in the market.

- Morning–Day Session (European and N. American Session)

The CPI flash estimates for the Eurozone were reported lower than expected indicating that indeed inflation in the Eurozone is cooling. Headline inflation eased to 2.4% and core inflation dropped to 3.6%. European Central Bank officials keep insisting that interest rates need to stay high though. There was no shock recorded at the time of the release. The EUR lost against the dollar steadily overall yesterday.

At 15:30 the Core PCE price Index monthly figure was reported as expected, at 0.2% change. No impact was reported in the market at that time, however, the dollar started to gain significant intraday appreciation against other currencies after that time. Initial jobless claims, which rose to 218k last week, remain close to the estimate and do not deviate greatly from the 200K numbers. It is higher though, indicating further labour market cooling.

Pending Home Sales change was reported with a negative figure, lower than expected though, enhancing the picture of a more cooling economy.

General Verdict:

____________________________________________________________________

____________________________________________________________________

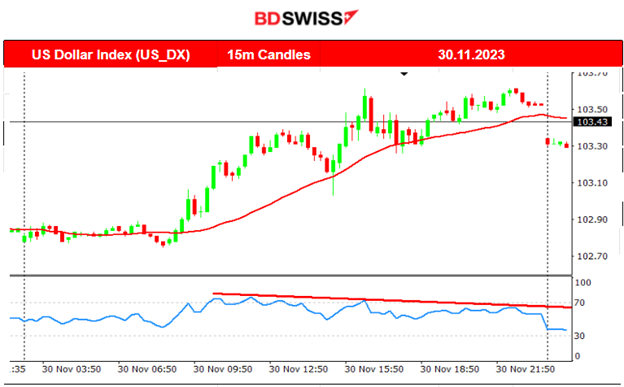

FOREX MARKETS MONITOR

EURUSD (30.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair started to move lower early when the European session started and remained on that path for the rest of the trading day. Lower inflation reports for the Eurozone kept the pair to the downside while the dollar was gaining ground. The inflation data and Jobless claims for the U.S. were reported roughly as expected having thus no major impact but a steady USD appreciation against the EUR and other currencies bringing the EURUSD down for the trading day.

___________________________________________________________________

___________________________________________________________________

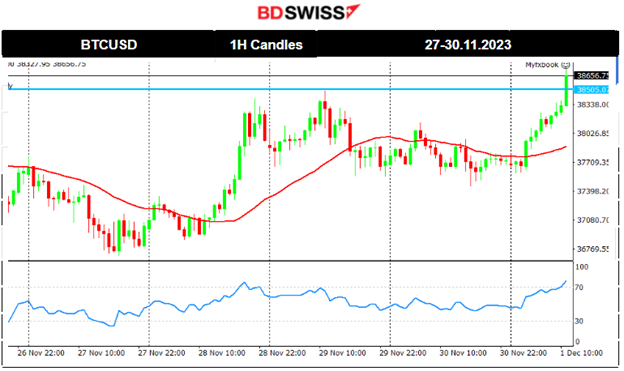

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin currently broke the 38500 level and is moving to the upside. That was a strong resistance as the chart depicts. The market had tested that level on the 28th and on the 29th without success.

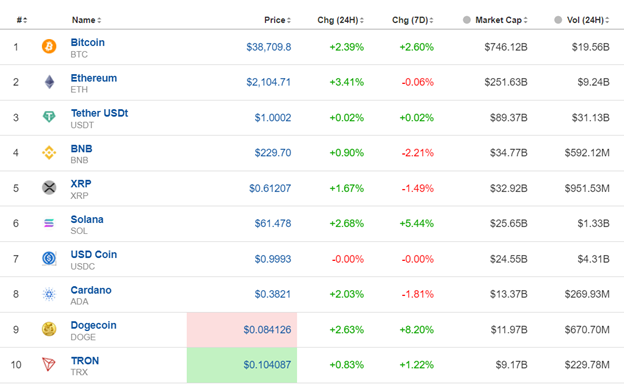

Crypto sorted by Highest Market Cap:

Crypto performance has increased significantly in the last 24 hours. Most cryptos show gains of more than 2% during that period.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The index was moving sideways with high volatility this week when on the 29th Nov the volatility levels increased further. The index experienced a strong downward reversal from the 29th to the 30th Nov and a retracement back to the mean followed. Deviations from the mean reached near 150-200 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

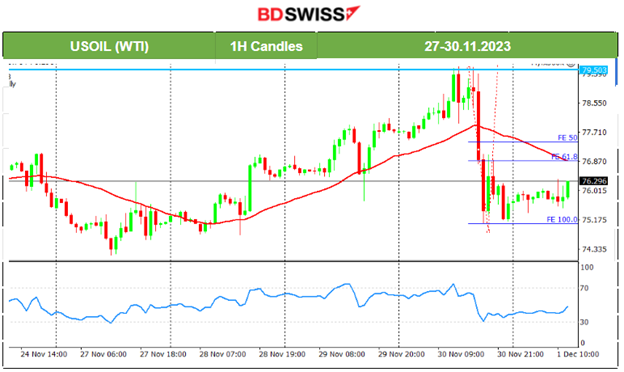

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude experienced a short uptrend from the 28th to the 30th of Nov. It reached the resistance near 79.5 USD/b and dropped suddenly after it was announced that the OPEC+ producers agreed to voluntary oil output cuts for the first quarter of next year that fell short of market expectations. Price dropped sharply reaching the support near 75 USD/b where it stayed in consolidation until probably experiencing the retracement back to the mean, expected today.

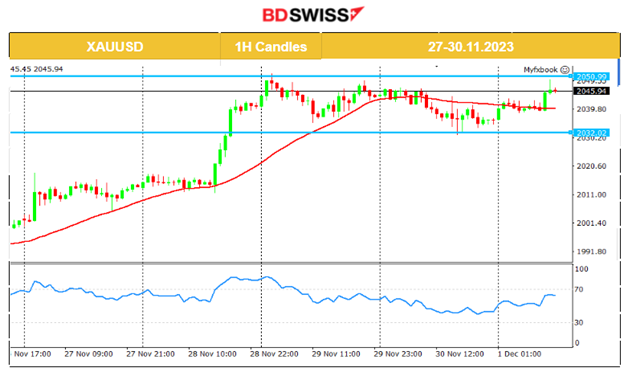

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold finished with the uptrend and remains in consolidation. It is currently in a range with support at near 2032 USD/oz and resistance at near 2050 USD/oz. The RSI does not give an indication of a bearish divergence currently so the possibility of an uptrend continuation cannot be excluded. What is important now is the breakouts that are the best tools we have currently indicating the future price direction.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (01 DEC 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No significant news announcements , no special scheduled releases.

- Morning–Day Session (European and N. American Session)

Employment data releases for Canada are taking place at 15:30 and are expected to have a strong impact on the market. The CAD pairs could see an intraday shock. Employment change is expected to be reported lower while the unemployment rate is expected to be reported higher. This is normal as the interest rates are still kept high.

U.S. ISM manufacturing PMI is expected to see an increase. This coincides with recent reports of the U.S. economy seeing improvement in growth levels. The USD might be affected greatly at that time but we do not expect significant shock at the time of the release.

General Verdict:

______________________________________________________________