Weekly Outlook

Fall in U.S. Job Openings, Low U.S. NFP Data, Drop in Canada’s Employment, Worse PMIs, U.S. CPI Data Ahead

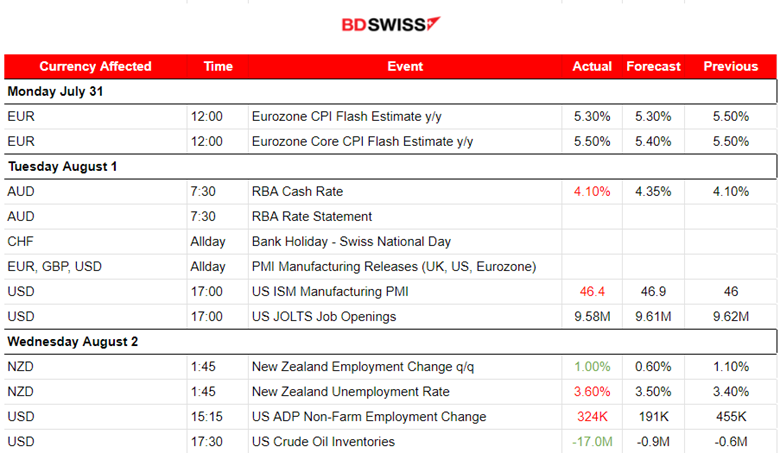

PREVIOUS WEEK’S EVENTS (Week 31 July – 04 Aug 2023)

Announcements:

U.S. Economy

The last week’s reports showed a fall in U.S. job openings to the lowest level in more than two years in June, a level consistent with tight labour market conditions. They dropped 34K to 9.582M, lower than expected and the lowest level since April 2021.

According to estimates, manufacturing employment likely rose by 5K jobs last month.

Automatic Data Processing (ADP) Inc released the report for the U.S. Employment Change for July, which measures the change in the number of employed people in the U.S. It was reported to be 324K, better than the expected 189K, but below the previous 455K, pointing to continued labour market resilience.

Fed officials achieved inflation slowing down without creating the massive unemployment seen in a recession.

The advance figure for seasonally adjusted initial claims was 227K, indicating an increase of just 6K from the previous week’s unrevised level of 221K. These are very low numbers though.

Most economists believe the U.S. central bank will probably not raise rates again this cycle since they see a huge desired drop in inflation. The pause of hikes will keep the economy in the current favourable condition, avoiding any recession-related implications.

According to the JOLTS report, the Labour Department showed that there were 1.6 job openings for every unemployed person in June and little changed since May. Nonfarm Payrolls likely increased by 200K jobs in July, after rising by 209K in June. The unemployment rate is forecast to be unchanged at 3.6% in July. Strong job growth in July was supported by the ADP’s national employment report, which pointed to solid private hiring last month.

he Nonfarm Payrolls were reported lower than expected in July, at 187K, while the unemployment rate in the U.S. declined back to 3.5%. Remarkably, job gains in May and June were revised lower showing that the effect from hikes was actually stronger. The data for June was actually revised to show 185K jobs added instead of the previously reported 209K. The job growth in June was the slowest since December 2020.

According to the recent CPI change reports, annual increases in prices slowed sharply in June. These mixed data only support the fact that the labour market is still showing resilience.

New Zealand

New Zealand unemployment rose to 3.6% in the second quarter and wage inflation showed signs of slowing, indicating a weakened labour market. The Reserve Bank has signalled that it has raised rates sufficiently to tame inflation and that the economy has stalled, expecting a further increase in the unemployment rate.

Labour market tightness and elevated wage and core inflation could remain at troublesome levels still. Inflation lies at 6% in the second quarter, down from 6.7% in the first quarter. The Official Cash Rate at 5.5% is high enough to close the cycle with aggressive rate hikes. However, economists expect one more increase to take place.

Canada Economy

The employment change in Canada had a reported negative figure in July, -6.4K, instead of a big expected positive change, which surprised everyone and shook the market.

The jobless rate rose up to 5.5%, enforcing analyst expectations that the Bank of Canada (BOC) will pause rate hikes.

_____________________________________________________________________________________________

Inflation

Eurozone: According to Eurostat, the Euro area annual inflation is expected to be 5.3% in July 2023, down from 5.5%.

Compared to the U.S.: Inflation in the United States has indeed succeeded in causing a significant drop but the economy, however, has shown resilience to the aggressive hike policy. The Eurozone struggles, on the other hand, since the economy is slowing down significantly, as the recent economic data suggest.

An index of Eurozone banks edged up 0.2% after the European Banking Authority’s (EBA) annual stress test results showed three of 70 banks from the European Union failed to meet binding capital requirements.

_____________________________________________________________________________________________

Interest Rates

Australia: The Reserve Bank of Australia (RBA) decided to leave the Cash Rate target unchanged at 4.10% for a second straight month, saying past increases were working to cool demand and it will proceed with more tightening if necessary.

RBA forecast for headline inflation is that it would return to within its 2-3% target range by late 2025, from the current 6%, with output and employment continuing to grow.

Markets expect another rate hike to be high. Both National Australia Bank and Goldman Sachs see a hike in November, bringing the cash rate to 4.35%, compared to expectations for two hikes before.

United Kingdom: The Bank of England’s Monetary Policy Committee (MPC) decided to increase the Bank Rate by 0.25 percentage points, to 5.25%.

It is noteworthy that two members preferred to increase Bank Rate by 0.5 percentage points, to 5.5%, and one member preferred to maintain Bank Rate at 5%.

“The MPC wants the Bank Rate to be restrictive for sufficiently long to return inflation to the 2% target,” the BoE said in fresh guidance. It has already warned that borrowing costs were likely to stay high for some time as it continues to battle high inflation.

Governor Andrew Bailey said: “We might need to raise interest rates again but that’s not certain”. The Bank forecasts that inflation will be below 3% in a year without the economy falling into a recession.

_____________________________________________________________________________________________

Source:

https://www.reuters.com/world/us/us-job-openings-fall-more-than-two-year-low-june-2023-08-01/

https://www.reuters.com/markets/us/us-private-payrolls-beat-expectations-july-adp-says-2023-08-02/

_____________________________________________________________________________________________

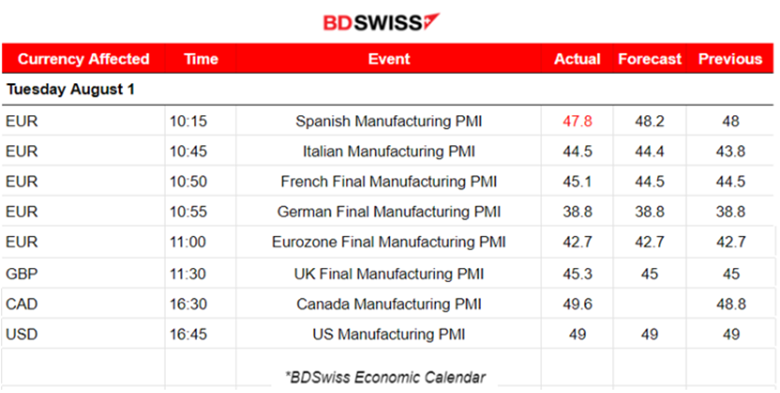

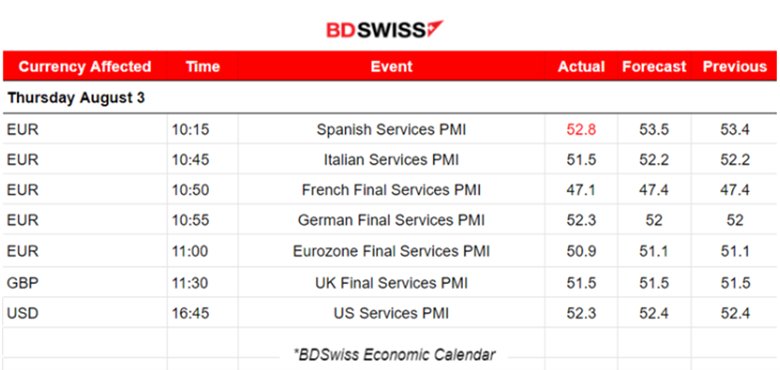

Currency Markets Impact – Past Releases (Week 31 July – 04 Aug 2023)

U.K.: Manufacturing PMI drops to a seven-month low with accelerated rates of contraction in output, new orders and employment.

Canada: PMI figure is just below 50 points indicating that the manufacturing sector remained in contraction territory during July, but only just. Further deterioration of operating conditions in July was observed despite a rise in production.

U.S.: The sector’s business health also declined during July, according to the latest PMITM survey from S&P Global. Another monthly contraction in new orders, as domestic and external demand conditions remained muted. New orders dropped and companies increased employment faster, having greater confidence in the outlook for output.

Germany: Due to stubbornly high prices the German service sector shows a substantial loss of momentum at the start of the third quarter. The index shows 52.3, indicating no actual improvement remaining just a couple of points above the 50 level that separates contraction from expansion.

France: A disheartening report for this economy as the PMI index shows 47.1, lower than the previous. This economy deteriorates at a faster pace in July amid worsening demand and persistent inflation.

Eurozone: PMI figure for services is actually lower at 50.9. The manufacturing downturn worsens and the service sector seems to not be making progress. The rate hikes are apparently having a negative impact on the economic activity of both sectors.

U.K.: The United Kingdom experienced another period of low business activity in the services sector during July. The index figure remains at 51.5, just 1.5 points above the threshold of 50, in the expansion area. However, this data show very weak performance in services for a long time now in the U.K.

U.S.: Lower U.S. business activity growth in July since demand for services eases. The PMI shows 53.3, just a bit lower than the previous figure but in the expansion area still. Thus further expansion across the sector was reported at the start of the third quarter, highlighting that business activity and new orders increased again, at slower rates though, and more exports with more sales. Better business conditions than any other region I would say according to these data.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

DXY (US Dollar Index)

The Dollar experienced strength last week. The index was moving upwards while being over the 30-period MA but reversed on the 3rd of August. The news regarding the United State’s business conditions was reported as not so great but better than other economies. On the 4th of August, the low NFP figure release caused a huge drop followed by a retracement.

EURUSD

Obviously, the USD is driving the pair path. The EURUSD has been experiencing a downtrend as the USD strengthened. The RSI was showing signs of bullish divergence. The pair eventually stopped at the support near 1.09145 and eventually reversed. On the 4th of August, the employment data for the U.S. pushed it upwards as the USD depreciated significantly.

_____________________________________________________________________________________________

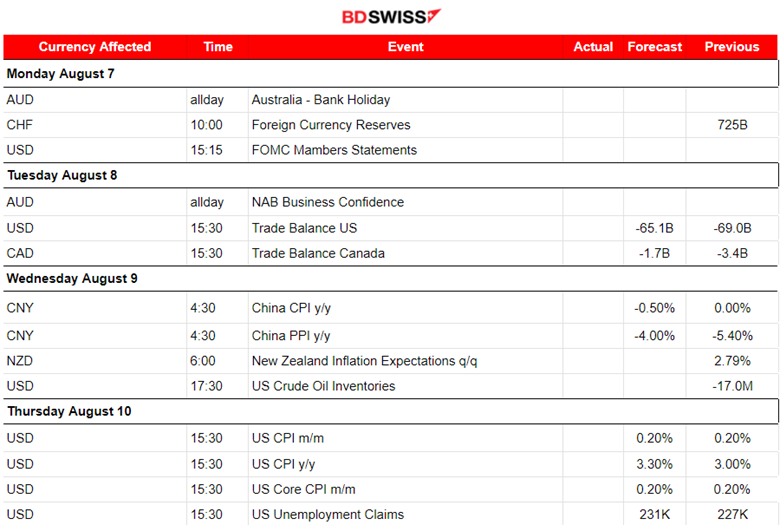

NEXT WEEK’S EVENTS (07 Aug – 11 Aug 2023)

Important news this week involves inflation-related figures. We have CPI changes on August 9th for China and on August 10th for the U.S.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

A negative figure, -17M showed that during the previous week, way less amount had remained in inventories. Yesterday, the price was showing early signs of bullish divergence, with lower lows, while the RSI was showing higher lows. At the start of the European session, the price eventually jumped, reversing, crossing the MA and moving significantly to the upside. The major reversal on the 3rd of August and the further climb to higher levels of the Crude price is explained by the recent production cuts announcements. “The Joint Ministerial Monitoring Committee (JMMC) expressed its recognition and support for the efforts of the Kingdom of Saudi Arabia aimed at supporting the stability of the oil market and reiterated its appreciation for the Kingdom’s additional voluntary cut of 1 million barrels per day and for extending it for the month of September. The committee also acknowledged the Russian Federation for its additional voluntary reduction of exports by 300 kbd for the month of September.”

Source: https://www.opec.org/opec_web/en/press_room/7199.htm

Gold (XAUUSD)

The price moved lower last week breaking some further support but remaining above 1930 USD/oz. It was in a consolidation phase, in range as depicted by the horizontal red lines, since the market was waiting for the U.S. labour data to act. On the 4th of August, it eventually broke the resistance upwards and reached even 1947 USD/b as the USD suffered strong depreciation with the NFP release.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The U.S. stock market experienced high volatility recently but did not show any significant signal that the crash that it experienced after the Fitch Ratings actually ended. After the NFP release yesterday, the benchmark indices actually had not been affected significantly. Only after the market opened at 16:30, they eventually resulted in a drop. Now they are testing important support levels, just like the NAS100 as depicted at near 15260 level, and if they eventually brake, they might trigger a downtrend signal. The RSI signals a bullish divergence and that’s why the support is actually significant.

_____________________________________________________________________________________________