Weekly Outlook

Main Driver is USD, Central Banks Intentions, Rising U.S. Stocks, Gold Price Decrease, Stabilized Crude

PREVIOUS WEEK’S EVENTS

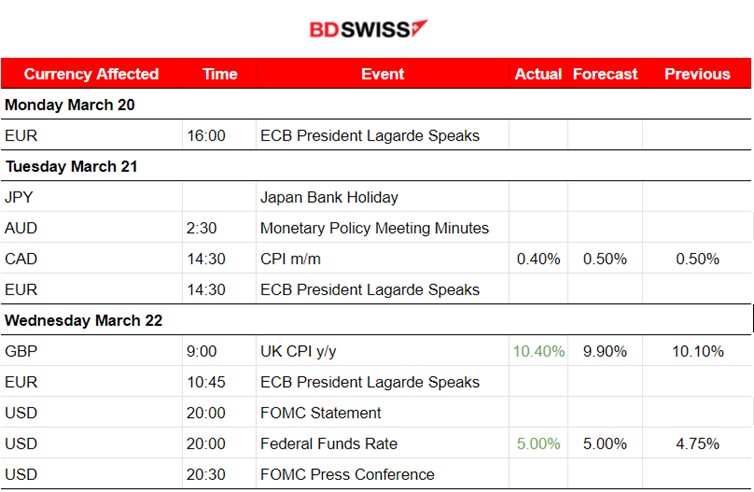

Announcements:

U.S. Banking Crisis

During the past week, we observed the chaos and uncertainty that the recent U.S. banking sector has experienced and the highly volatile market conditions.

The World Central Banks decided to coordinate in order to enhance the provision of liquidity in an attempt to counter the effects of the U.S. bank failures. On 19 March 2023, Swiss investment bank UBS Group AG agreed to buy Credit Suisse for CHF 3 billion. This takeover announcement was going to help stabilise the banking crisis, thus Swiss National Bank supported the deal.

The U.S. makes the necessary checks and proceeds to emergency meetings in order to make sure that it can insure and safeguard the depositors’ money. Regulators have already taken steps to help banks keep up with any demands for withdrawals. The Treasury is ready to take more actions to stabilise the banking sector. According to Treasury Secretary Janet Yellen, the federal emergency refunds to depositors at Silicon Valley Bank and Signature Bank could be deployed again if necessary.

Source: https://www.cnbc.com/

Source: https://www.federalreserve.gov/

Source: https://www.investing.com/

Source:https://www.bnnbloomberg.ca/

_____________________________________________________________________________________________

Inflation

The RBA (Reserve Bank of Australia) policymakers noted that inflation is still too high. It is expected that a 25 basis points (bps) rate hike for March’s monetary policy will be applied. The monthly U.K. CPI data surprised the markets showing an increase, another two-digit inflation rate, to 10.4% from February’s 10.1%, while in the U.S. and the Eurozone, inflation has eased to 6% and 8.5% respectively.

ECB President Lagarde said that inflation is likely to decline this year but, for now, steps to bring down inflation to the medium-term target level must be taken.

Source: https://www.rba.gov.au

Source: https://www.ecb.europa.eu/press/key/speaker/pres/html/index.en.html

_____________________________________________________________________________________________

Rate Hikes

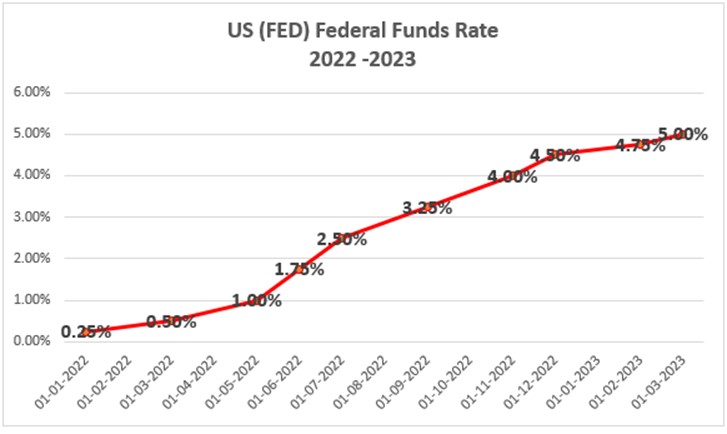

The FED has raised the policy rate to 5.00% as expected. However, in its report, it also signalled the termination of its aggressive streak of rate increases.

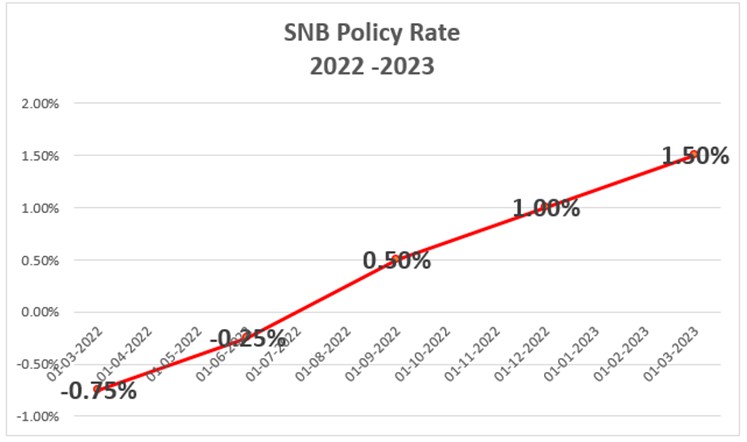

The Swiss National Bank raised the SNB policy rate to 1.5% as expected. Additional future rises will possibly follow, if necessary, in order to ensure price stability over the medium term.

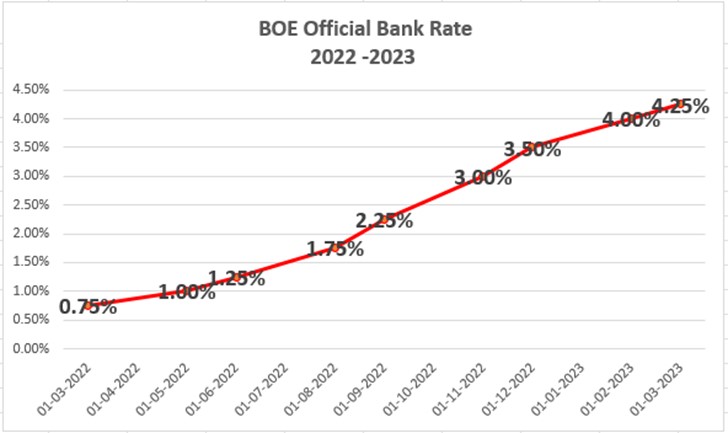

BOE increased the Bank rate to 4.25% as expected and the same monetary policy will continue in the future, ensuring that inflation will return to the 2% target sustainably in the medium term.

Source: https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm#calendars

Source: https://www.snb.ch/

Source: https://www.bankofengland.co.uk/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases:

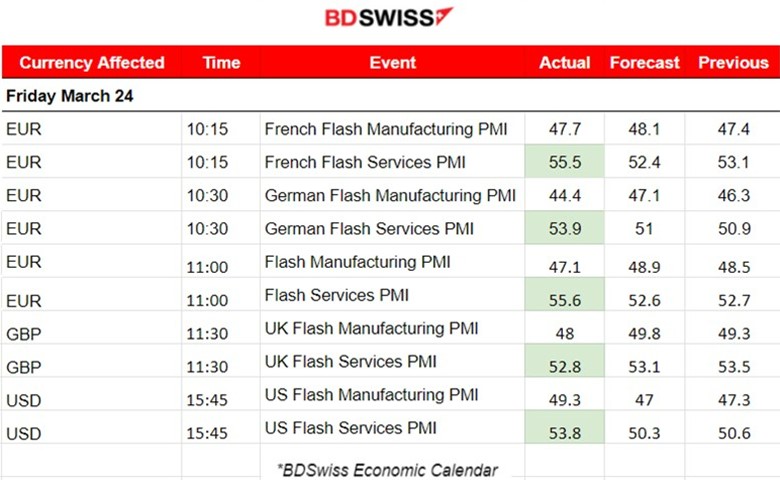

With the PMIs release, the major pairs and currencies, such as USD, GBP and EUR, experienced volatility but no major shocks or trends were observed.

_____________________________________________________________________________________________

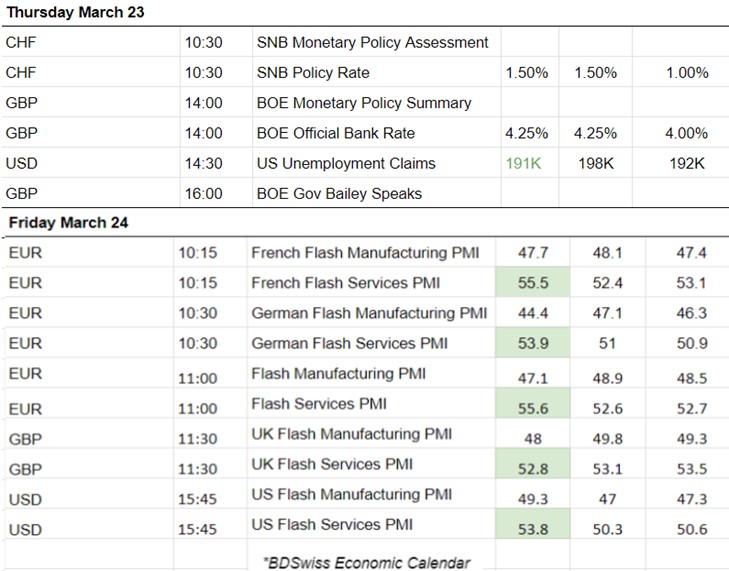

Summary Total Moves – Winners vs Losers (Week 20-24 March 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

The previous week began with news showing expectations of a US Dollar decline and pushed markets for further appreciation of EURUSD, and USD pairs in general. Thus, we see that the EURUSD follows an upward trend from the beginning of the week as the Euro appeared strong before the Fed’s decision on the 22nd of March at 20:00 (GMT+2).

Following the decision of the FED for a rate hike on the 22nd of March, it seems that the figure pushed the EURUSD even further upwards at 1.09298.

Later on the 23rd of March, the market did not just retrace, but rather, a reversal took place. After breaking significant intraday support levels, the pair moved below the MA, signalling the end of the upward medium-trend.

The pair eventually moved further below, following the positive PMI figures for the U.S. Thus, the US dollar appreciation and EURUSD remained at low levels, namely at 1.07583, compared to the 170 pips higher, the highest level of the week.

Trading Opportunities

At the start of the week, the absence of shocks and major releases caused the pair to remain in range, creating opportunities for catching short price reversals. Since no lasting shock is expected, it would be good to look for the end of long moves and use the Fibo tool to catch the retracements.

Fibonacci Expansion can help in identifying the retracement level of 61.8% and 50%, as per the chart. Price reversals are supporting the retracement opportunity.

In times of scheduled releases of important figures, traders should use caution as the market moves very rapidly. During such releases, catching retracement is not easy.

GBPUSD

The GBPUSD pair has been moving around the 30-period MA for the past few days with no clear medium-trend upwards or downwards. Since the 21st of March, high volatility was observed with maximum deviations from the MA being about 70-90 pips. Price reversal happened on the 21st with the pair crossing above the 30-period MA and another one on the 24th with the price crossing below the MA.

Both shocks from the U.K. CPI and FOMC news on the 22nd of March caused high volatility but the pair remained above the MA during that time.

Trading Opportunities

Reversals in general create retracement opportunities. The reversal will happen when the price crosses the MA, moving rapidly and deviating from the MA significantly.

Volatility on the 24th of March was expected. The market should break support or resistance levels and deviate significantly from the MA. The market eventually broke the support level of 1.226 and going short after that would be correct.

Relevant Technical Analysis here on TradingView: https://www.tradingview.com/chart/GBPUSD/2YOLefhN-GBPUSD-Breakout-Downwards-24-03-2023/

USDJPY

The pair has been experiencing a downward move caused by the recent news related to the U.S. regional bank failures. As we have observed previously, the JPY has also been gaining momentum on the positive against other major currencies this month. However, on the 21st of March, the pair experienced a price reversal and crossed the 30-period MA over and upwards. Another reversal took place the next day, on the 22nd of March. The FED decision and the FOMC Press conference statements caused the pair to move below the MA and rapidly downwards finding support at the 130.420 price level. Retracement followed and then a downward short trend. The pair continued its path moving below the MA until the end of the week.

Trading Opportunities

When the price crosses and moves rapidly above/below the MA with high speed, it signals a shock that is not going to last for long. An opportunity was created on the 21st and 22nd of March for catching the retracement.

The Fibonacci expansion could be used to identify the retracement levels and, thus, go long to capture it until the 61.8% level.

Our Technical Analysis here on TradingView: https://www.tradingview.com/chart/USDJPY/vLxgTB9O-USDJPY-Might-Retrace-23-03-2023/

DXY (US Dollar Index)

The below chart shows the price path of the Dollar Index, the symbol for the US dollar index, which tracks the price of the US dollar against six foreign currencies, aiming to give an indication of the value of USD in the global markets.

We can see clearly now that the USD was depreciating since the start of the week, following a downward path. On the 22nd of March, EURUSD and GBPUSD experienced a shock upwards while USDJPY a shock downwards, at 20:00, during the FOMC Statement and FED Funds Rate decision. The pairs have obviously moved from the US Dollar depreciation, as confirmed by the DXY chart, since we see the price dropping heavily during that time. In the following days, though, we see that the DXY appreciates back to the typical levels of the week, around 102.8 by the end of the week. By looking at the major pairs’ paths and the path of DXY, it is concluded that the USD was the main driver of the markets this week.

_____________________________________________________________________________________________

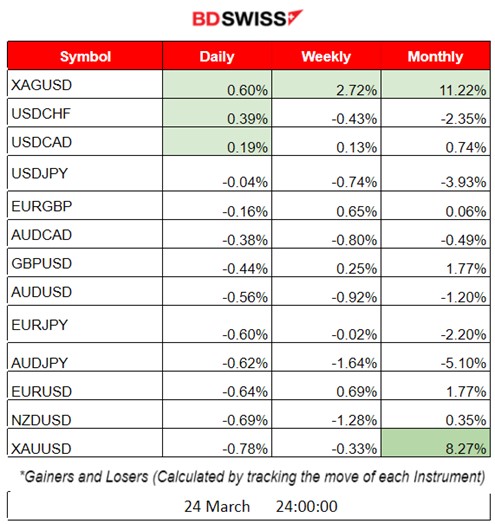

U.K. Consumer Price Index (CPI)

It is released monthly and considered the UK’s most important inflation data because it’s used as the central bank’s inflation target. U.K. inflation rose unexpectedly, giving a surprise when the CPI data was released on the 22nd of March, namely a 10.4% change.

Economists were expecting the reading to fall back into single digits. The Bank of England (BOE) responded with a rate hike the next day, the 23rd of March, increasing the official bank rate to 4.25%. They will need to boost the interest rates again. Policymakers led by governor Andrew Bailey will need to proceed with making more “aggressive” decisions regarding rate hikes in order to reach the inflation target. Several speeches from the BOE governor are scheduled this week so the intentions of the BOE will hopefully be revealed.

_____________________________________________________________________________________________

U.S. Federal Reserve (FED) Fund rate

The Federal Reserve raised the interest rates on the 22nd of March, increasing the federal funds rate by a quarter percentage point to a range of 4.75% to 5%; the highest since September 2007. This is the second straight rise of 25 basis points, following a string of aggressive moves that started in March 2022, when rates were near 0.5%.

Statements from the FED were optimistic about the economic conditions and stability of prices. It was emphasised that the banking system is sound and resilient and the economy and financial system remain healthy enough to withstand the string of bank collapses. However, it was said that further monetary policy decisions should be taken only after gathering more data regarding the recent banking crisis.

Fed policymakers projected that rates will be at about 5.1% by the end of 2023; a signal that affected the Stock market and gave rise to their prices.

_____________________________________________________________________________________________

SNB (Swiss National Bank) Policy Rate

The Swiss central bank hikes the interest rates by 50 basis points to 1.50% on March 23rd, countering the renewed increase in inflation.

_____________________________________________________________________________________________

U.S. Unemployment Claims

The number of Americans filing new claims for unemployment benefits was lower than expected last week. The failure of two regional banks seems to not have had a critical impact on the economy. The next expected figure is 195K, which is higher than the previous 191K. This is rather logical considering the recent U.S. economic developments.

The biggest number of U.S. Unemployment Claims (UC) was reported on the 9th of March, with a 211K figure. If we take into account the recent business economic indicators, such as the PMIs, they show a boost in business activity, explaining the lower UC numbers that were reported later in March, reaching as low as 191K.

_____________________________________________________________________________________________

PMIs

With the latest U.S. PMI data for both the manufacturing and services sectors, the U.S. companies show expansion in business activity in March. The same goes for the Eurozone and the U.K.

Manufacturing PMIs

The released figures show very few differences in the manufacturing sector and they are lower than expected. They were lower than the forecasts except for the U.S. which experienced a 2-point increase, to 49.3. Even so, all regions have below 50 Manufacturing PMI index levels.

The Service PMIs

All released figures from the previous week showed a business activity expansion as they were above what was expected. Service PMIs are above 50 for all economies and show that the number is increasing after every release, except for the U.K. We observe that the previous figure was 53.5 against the newly released figure of 52.8.

_____________________________________________________________________________________________

NEXT WEEK’S EVENTS

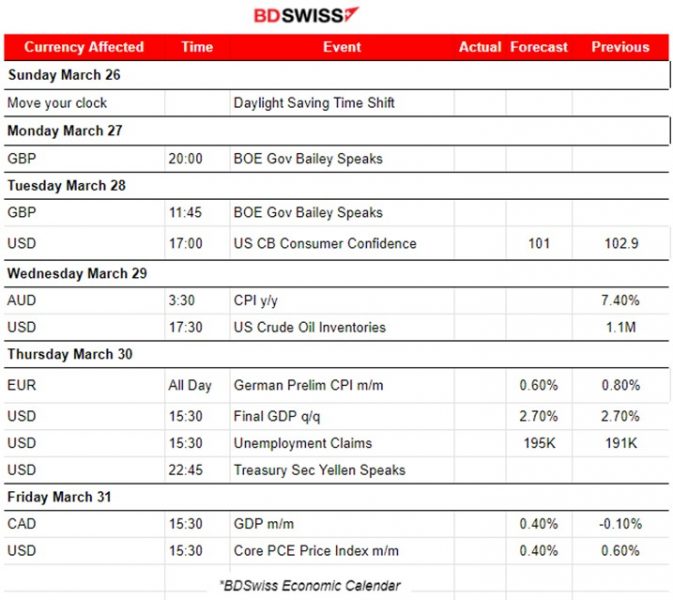

This week, we have frequently scheduled speeches from the BoE governor Bailey due to the fact that central banks have to address the recent negative developments in the banking sector and report their actions and intentions to the public. The U.S. Treasury Secretary Janet Yellen will also give a speech.

It will be interesting to see the U.S. CB consumer confidence index figure which acts as a leading indicator of economic activity.

The final U.S. GDP and U.S. Unemployment Claims figures will probably have a significant impact.

Currency Markets Impact:

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

AUDUSD

The AUDUSD pair also experienced high volatility last week, mainly from the USD which was the leading driver of the market. The chart looks very similar to GBPUSD as depicted previously.

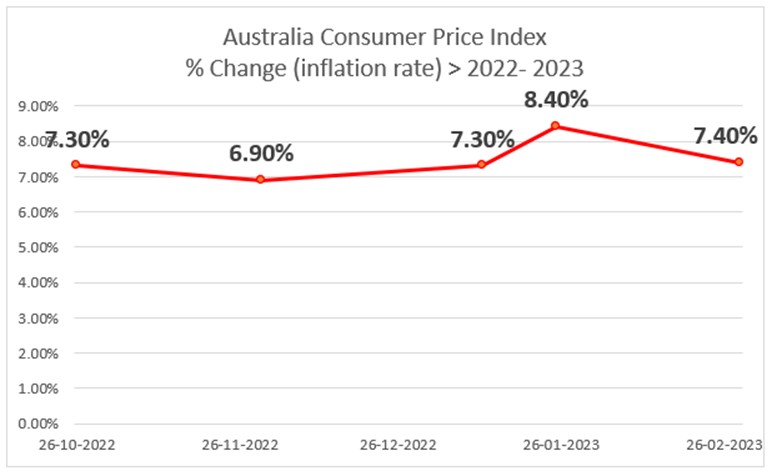

This week, we have the release of Australia’s CPI figure on the 29th of March, which is scheduled to be released monthly. This is the inflation-related data, important to currency valuation because rising prices lead the central bank to raise the interest rates to counter rising inflation.

We can see from the chart that Australia’s inflation reached 8.4% this year, as per the release on January 25, and dropped to 7.4% in March.

The announcement is expected to have a short-term shock on the AUD pairs and it will take place during the less volatile Asian Trading Session.

_____________________________________________________________________________________________

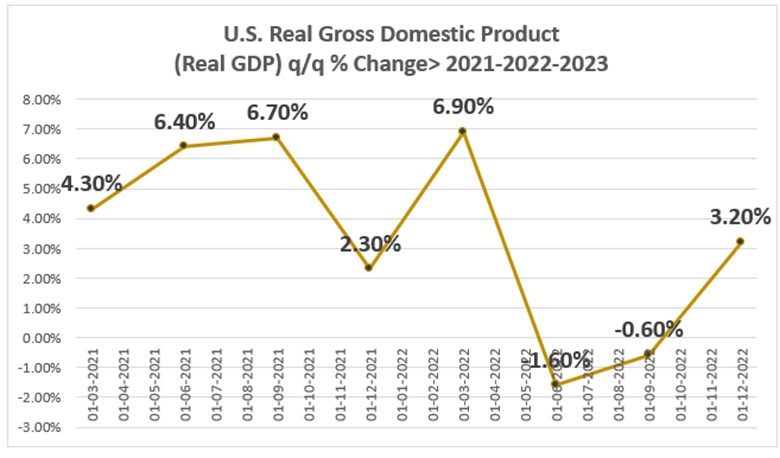

The USD will be affected greatly this week by the long-awaited Final GDP q/q (%change) figure release. That is the annualised change in the inflation-adjusted value of all goods and services produced by the U.S. economy.

As shown on the graph, it recorded an increase for the first 3 quarters of 2021, reaching 6.7% but a drop to 2.3% was reported for the last quarter.

The first quarter of 2022 rose again to 6.9% but later recorded a large decrease in 2022’s second quarter. The latest recorded change for the last quarter of 2022 is 3.20%. Economists expect the next figure to be lower, to 2.7% for the first quarter of 2023.

______________________________________________________________

COMMODITIES MARKETS MONITOR

US Crude Oil

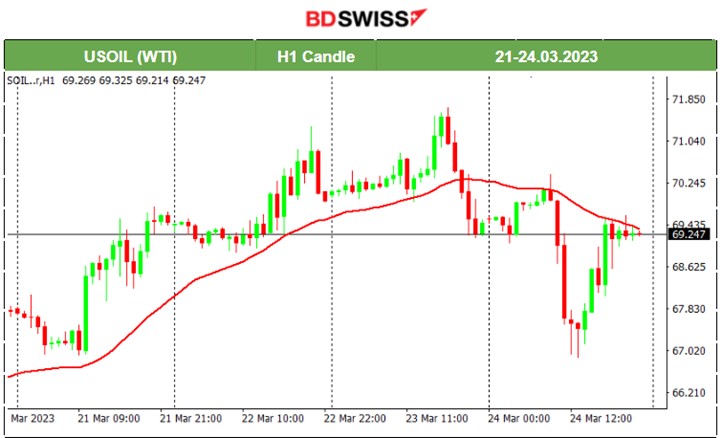

Crude price has been rising in the past few days. On the 23rd of March, the price experienced a fall and reversed below the 30-period MA. It was about to stabilise near the 70 USD level but on the 24th of March, volatility continued with the CFD price falling close to 67 USD and then retracing back to 69 USD. Price remains stable around the 70 USD level.

Gold (XAUUSD)

The price of gold has also been experiencing volatility last week but, until the 24th, the overall change was positive (close to 8%). Due to the recent banking crisis, investors preferred to invest in gold, rising its value this month to over 2000 USD per ounce. Price reversals are observed with the price crossing the 30-period MA, even on the 24th of March, signalling a short-term trend change. Today, March 27, Gold has been rapidly falling by more than 20 USD so far.

EQUITY MARKETS MONITOR

NAS100 (NASDAQ – NDX)

The stock market has experienced high volatility in general, with indices prices moving sideways and around the 30-period MA. The overall results for prices ended up higher for the week. The main indices eventually climbed at the end of the week, when major rate-sensitive technology and growth stocks advanced, after news started to spread that the Federal Reserve might pause the interest rate hikes.

In addition, US equity futures values increased since the U.S. authorities stated their intention to help the troubled regional banking sector further. The week starts with low volatility, with US indices CFD prices moving sideways. We expect high volatility at 16:30 (server time EEST- UTC+3) when the NYSE opens.

______________________________________________________________