Weekly Outlook

Tentative U.S. Debt Deal Reached, U.S. Rate Hike Likely to Pause, Eyes On U.S. Labor Market Data, Manufacturing PMIs Ahead

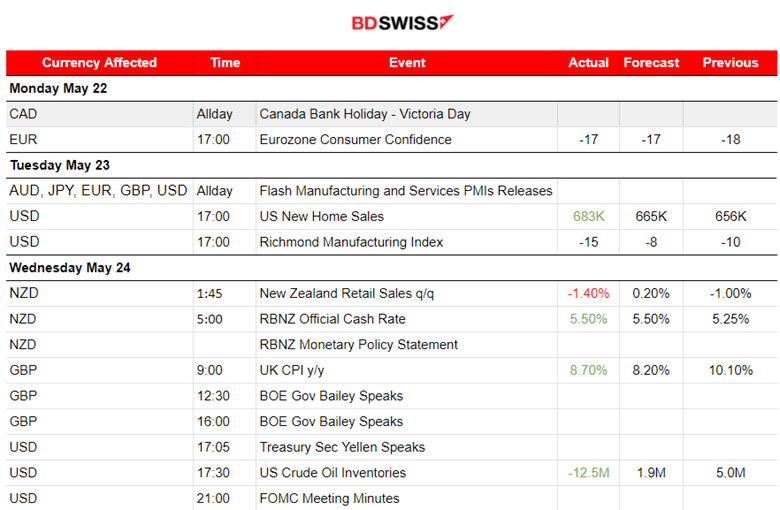

PREVIOUS WEEK’S EVENTS (Week 22-26 May 2023)

Announcements:

U.S. Debt Ceiling Talks

Biden returned from his trip last week and resumed talks as soon as possible with the House Speaker, Kevin McCarthy. Despite the talks, no deal was reached about the debt limit during that time. Treasury Secretary, Janet Yellen had warned many times before that it was “highly likely” her department would run out of sufficient cash in early June and that default could come as soon as June 1st. A productive discussion, but no agreement was reached at the time.

During the week, Yellen maintained her position that the debt ceiling default will headline in early June according to her speech at Wall Street Journal forum. Yellen said that she was expecting the U.S. government’s bills to be paid only until June 1st without a debt limit increase. The Treasury secretary said payment prioritisation is not operationally feasible for the government. “We simply have to raise the debt ceiling,” she said.

Later on, further talks during the week took place, with the U.S. announcing that it was closer to having a deal in place regarding the debt ceiling. A deal that would raise the government’s $31.4 trillion debt ceiling for two years while capping spending on most items. Biden said that they still disagreed over where the cuts should fall.

U.S. Treasury Secretary Janet Yellen announced on Friday that the U.S. will likely have enough reserves until at least June 5 this time, thus buying more time for the White House and congressional Republicans to reach a deal.

The U.S. Stock Market closed higher on Friday even though no final deal was reached last week, but only talks of progress.

All eyes are on these talks since should the U.S. default on its debt, even for just a few days, it could drive up interest rates and undermine confidence in the U.S. dollar.

A tentative agreement was reached over the weekend in the U.S. to raise the debt ceiling giving rise to European Stocks. U.S. President Joe Biden on Sunday finalised a budget agreement with House Speaker Kevin McCarthy to suspend the $31.4 trillion debt ceiling until the 1st of January, 2025, and said the deal was ready to move to Congress for a vote.

_____________________________________________________________________________________________

U.S. Economy

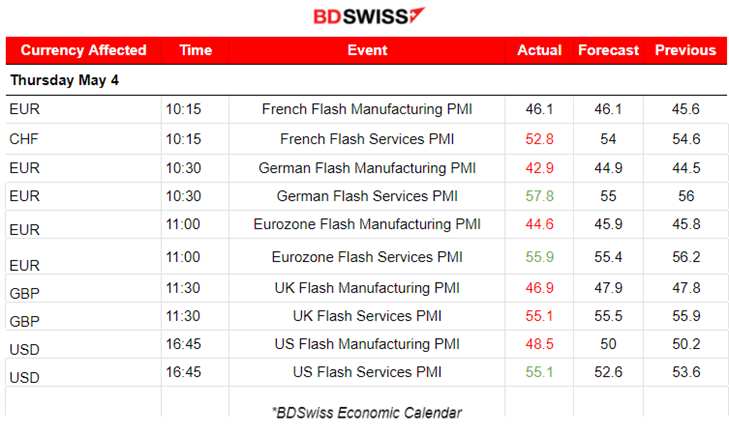

According to the Flash PMI data released last week, U.S. business activity increased in May attributed to strong growth in the services sector. The Flash U.S. Composite PMI Output Index rose to 54.5 this month.

These data confirm the current U.S. labour market resilience. However, most economists expect a recession in the second half of this year when taking into account the continuous rate hikes, tightening credit conditions and U.S. debt default risk with an upcoming debt ceiling rising.

The survey’s Flash Services Sector PMI rose to 55.1 from 53.6 in April, moving higher in the index’s expansion area.

In the week ending May 20th, the advance figure for seasonally adjusted initial claims was 229,000, a 4,000 increase from the previous week’s revised level. A revision took place because fraudulent applications created resilience bias in the Labour market. The Minutes of the Fed’s May 2-3 policy meeting published on Wednesday showed that policymakers “generally agreed” that the need for further rate hikes “had become less certain.”

According to the Gross Domestic Product figure released at 15:30 yesterday, the U.S. GDP increased by a 1.3% annualised rate in the first quarter. The Gross Domestic Income (GDI) declined by a 3.3% rate in the fourth quarter and revised down from the previously reported 1.1% pace of contraction. Economic activity may be contracting, however, the U.S. economy is probably not in a recession currently.

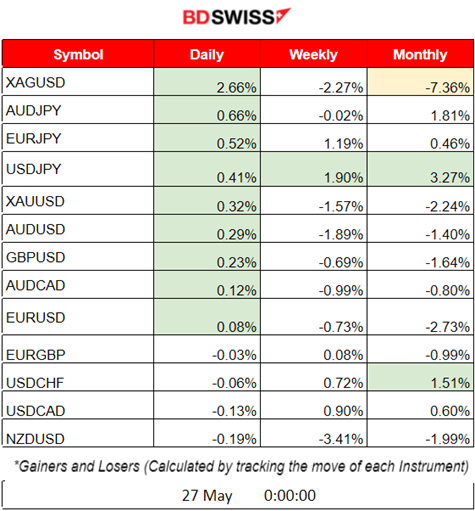

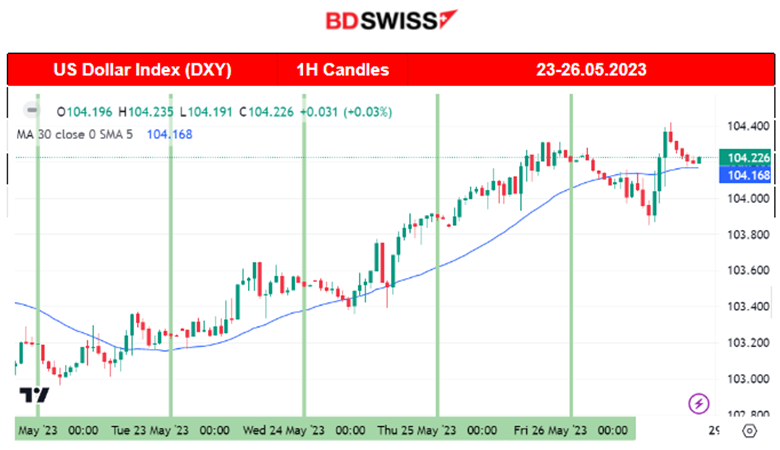

It is notable that the DXY (Dollar Index) increased overall last week.

Eurozone Economy

The Flash Consumer Confidence Indicator (CCI) for the EU and Euro area shows a -17 figure as estimated and so remains below 0 without improving. No significant impact at the time of the release.

This month’s Flash CCI is calculated by taking into account data from 25 EU countries (all except Ireland and Romania), covering 97% (EU) and 98% (Euro area) of the total private final consumption expenditure.

In May 2023, the flash estimate of the consumer confidence indicator improved further in the EU (0.6 percentage points (pps.) up) while remaining broadly stable (0.1 pps. up) in the euro area (EA). At -18.3 (EU) and ‑17.4 (EA) pps., consumer confidence remains well below its long-term average.

_____________________________________________________________________________________________

Interest Rates

NZ: New Zealand’s central bank (RBNZ) increased the Official Cash Rate (OCR) to 5.50%, from 5.25% in line with expectations. It also signalled that tightening is probably over, keeping the OCR to a restrictive level to ensure that consumer price inflation returns to the 1% to 3% annual target range while achieving the highest sustainable employment possible.

New Zealand’s annual inflation is currently running just below a three-decade high of 6.7%, with expectations that it will return to the central bank’s 1% to 3% target within two years.

At the time of the release, the NZD depreciated greatly causing the NZDUSD to drop sharply and more than 180 pips since that day with no significant retracement so far.

_____________________________________________________________________________________________

Inflation

U.K: U.K.’s CPI data finally show an annual 1-digit inflation. Inflation dropped to 8.7%. Specifically, the Consumer Prices Index (CPI) rose by 8.7% in the 12 months to April 2023, down from 10.1% in March. It fell by less than expected but fell nonetheless.

Inflation proved to be quite sticky, despite the measures taken. It is likely that the Central Bank will raise interest rates from 4.50% to 4.75% in June or further, economists expect. Finance minister, Jeremy Hunt said in a statement that rate hikes should continue in order to bring inflation down and according to the plan.

The BOE Governor, Andrew Bailey, had scheduled speeches to take place during the trading day after the inflation data release. During his talks, he stated that their projections show that they will meet the inflation target this year. The BOE expects a sharp decline in U.K. inflation throughout 2023.

U.S.: The Personal Consumption Expenditures (PCE) data were released on Friday showing that consumer spending was higher than the previous and more than expected in April according to the reported figures. These higher inflation-related figures could prompt the Federal Reserve to raise interest rates again next month.

According to previously reported labour data and strong PMI data, the Labor market is resilient enough and business activity is high, adding to the probability of one more hike in June.

The Fed’s Rate Hike decision will be affected by whether a debt ceiling agreement is reached. April’s employment data, NFP report, next Friday, 2nd June, will also have an impact. Some economists still believe that the Fed will leave rates unchanged but I would say that there is no sentiment supporting strongly one side at the moment.

Sources:

https://www.reuters.com/markets/us/yellen-maintains-early-june-us-debt-ceiling-deadline-2023-05-24/

https://www.reuters.com/world/uk/uk-inflation-rate-falls-87-april-ons-2023-05-24/

https://www.reuters.com/markets/rates-bonds/rbnz-raises-cash-rate-by-25-bps-55-2023-05-24/

https://economy-finance.ec.europa.eu/system/files/2023-05/Flash_consumer_2023_05_en.pdf

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (22-26 May 2023)

_____________________________________________________________________________________________

Summary Total Moves – Winners vs Losers (Week 22-26 May 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD was on a downward trend with the main driver of this path being the USD. It is clear that it is moving downwards while it is below the 30-period MA. The RSI shows higher lows in the last couple of days while the price is showing lower lows. It is true that the USD is the main driver of this path since it appreciated greatly last week. This apparent bullish divergence signals that the downward trend has ended and an upward movement is imminent.

DXY (US Dollar Index)

During the previous week, the dollar has appreciated significantly overall, against other currencies. Recent U.S. Debt-talks are having an impact on the USD but not intraday, rather a medium-term impact with the USD appreciating. The labour market is resilient, the inflation figures are indicating sticky prices and the market sentiment, after the FOMC Meeting Minutes report release, is more towards the idea that the Fed will not pause rate hikes. U.S. officials are spreading optimism that the Debt deal is close to being finalised and U.S. stocks are climbing ahead of NFP next week.

_____________________________________________________________________________________________

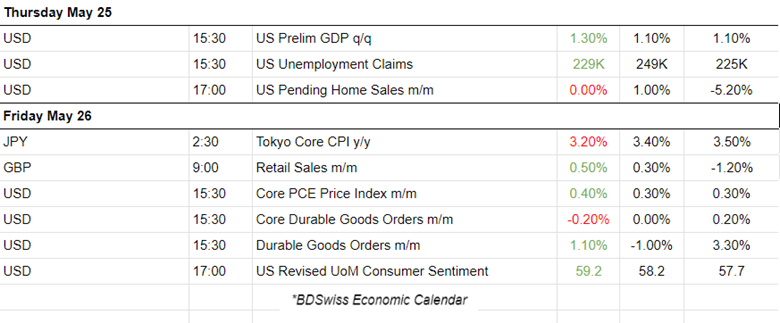

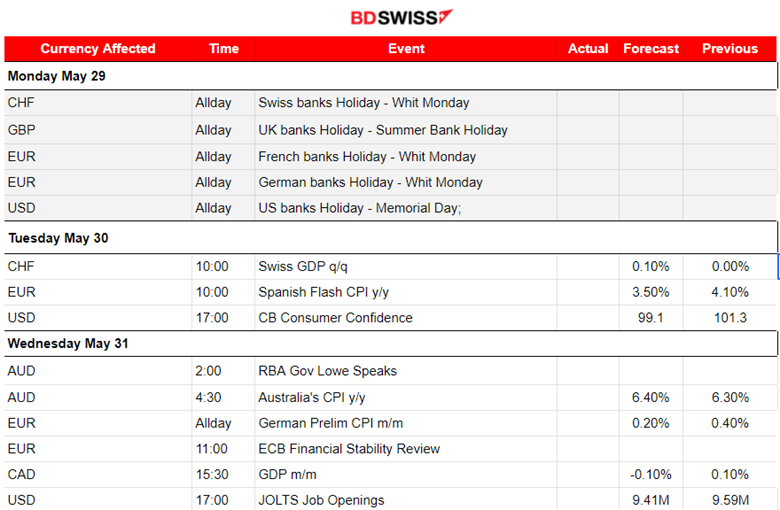

NEXT WEEK’S EVENTS (29 May – 02 June 2023)

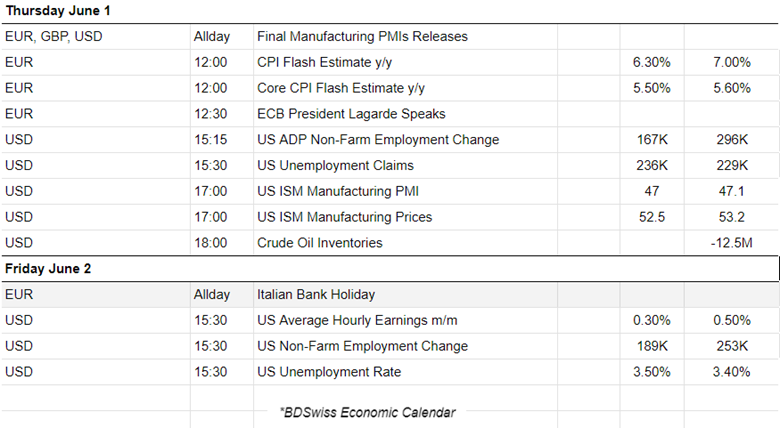

This week the Manufacturing PMI data will be released. Last week the Flash PMI data was released for the manufacturing sector, so no major impact is expected this week from these releases. However, some unusual volatility is expected.

Important U.S. Labour data this week involve the U.S. JOLTS Job openings, Unemployment Claims and Non-Farm employment change and Unemployment Rate.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude experienced a price reversal as it dropped rapidly on the 25th of May, crossing the MA and moving further downwards, a nearly 3 USD drop. After this high deviation from the MA, a retracement followed when important resistance levels broke near 72.1 USD/b. The retracement continued even higher than the 50% fibo level.

Gold (XAUUSD)

On the 25th of May, Gold experienced a drop when the U.S. Preliminary GDP and Unemployment Claims data were released. USD had appreciated greatly at that time. It experienced a nearly 21 USD drop at that time and found support at 1939 USD/oz. Retracement followed and Gold settled on a less volatile sideways path. On the 26th of May, it dropped when the PCE Prices and Durable Goods data were released at 15:30, testing once more the support near 1939 USD/oz. It eventually retraced back to the 30-period MA.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The index started on the 24th of May to show a reversal in price as it moved upwards crossing the 30-period MA and continuing with its upward path. The other U.S. indices, US 30 and S&P 500, formed similar paths indicating resilience in dropping but moving more sideways. However, on the 26th of May, all indices jumped ahead of the Memorial Day holiday for the U.S. on the 29th. Next week, we expect that the U.S. indices will be affected greatly by the Labor Data releases on the 2nd of June.

______________________________________________________________