Weekly Outlook

U.S. Debt-Default Fears Grow, Fed’s Powell Signals Pause, USD Weakens, FOMC Ahead

PREVIOUS WEEK’S EVENTS (Week 15-19 May 2023)

Announcements:

U.S. Debt Default and G7 Meetings

Catastrophic for the global economy will be the case if the U.S. defaults on its debt. The U.S. Treasury Department made it clear that the U.S. government’s bills will be paid only through June 1 if the debt limit remains at the current level.

Despite last week’s talks, no agreement was reached. Biden travelled to Japan on Wednesday for the G7 summit, saying that he will keep in contact while U.S. Secretary of the Treasury Janet Yellen warns: “Waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States.”, she said.

“If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests,” she said.

President Joe Biden expresses confidence regarding the debt ceiling and the upcoming crisis announcing that negotiators are probably going to reach an agreement.

“I’m confident that we’ll get the agreement on the budget and that America will not default,” Biden said Wednesday at the White House, shortly before departing to Hiroshima, Japan for a Group of Seven leaders summit.

Biden’s decision on leaving for the summit at such a critical moment raised criticism from the House Speaker, McCarthy and other Republican lawmakers.

The U.S. president announced that he is cancelling planned stops in Australia and Papua New Guinea and returning back for continuing negotiations by the beginning of next week. “We’re going to continue these discussions with congressional leaders in the coming days until we reach an agreement,” Biden said.

The whole world is watching as the U.S. stalls with growing fears of a U.S. debt default. The House Speaker and Republican Kevin McCarthy accused the White House of backtracking in talks on raising the U.S. debt limit.

“I don’t think we’re going to be able to move forward until the president can get back into the country,” McCarthy told reporters at the Capitol. “Just from the last day to today they’ve moved backwards. They actually want to spend more money than we spend this year.”

“We have to spend less than we spend this year,” McCarthy said, repeating his bottom-line demand.

The president called the speaker Sunday morning, Washington time, after the summit concluded. McCarthy says he’ll meet with Biden after ‘productive’ debt ceiling call

The G7 Meetings were in the world media spotlight this week. Finance ministers and central bankers from 7 industrialised nations – Canada, Italy, France, Germany, Japan, the U.K. and the U.S. – gathered together in Japan and special talks took place with reporters throughout the day. A formal statement covering policy shifts and meeting objectives is usually released after the meetings have concluded. Important subjects include bank failures and debt restructuring as the U.S. debt default is growing.

Meetings took place from Thursday through Saturday. Concerns discussed involved the collapse of Silicon Valley Bank and Credit Suisse’s takeover, the First Republic Bank’s failure, how to strengthen the global financial system and prevent bank runs of the kind that led to SVB’s collapse, the U.S. debt default crisis, and climate, energy and environmental issues. In addition, discussions for extra measures to support Ukraine or to punish Russia. Various sanctions had been in effect so far. Further concerns include world inflation, which remains fairly sticky, and the risks involved around the use of crypto assets.

Waiting for a conclusion while Media Headlines are already coming out:

- “Russia and China hit back at a G7 that saw them as a threat”.

- “Russia-Ukraine war: Zelenskiy welcomes ‘historic’ Biden decision to back fighter pilot training; US issues more Russian sanctions – as it happened”.

- “G7 tightens Russia sanctions, looks to cut China trade reliance”

U.S. Economy

The Empire State Manufacturing Index figure last week showed that business activity fell sharply in New York State. The headline index dropped, 42.6 points to -31.8. A reading below zero signals that the New York manufacturing sector is contracting.

On the other hand, U.S. Unemployment Claims were reported lower, even lower than expected, suggesting that the labour market remains strong still. Recession fears started to calm while the risk-on mood started to grow again. Recent previous high claim figures were actually distorted data due to fraudulent applications. The USD appreciated greatly against other currencies as investors switched their expectations.

Economists widely expect unemployment to climb higher with steeper interest rates. The Federal Reserve is watching the labour market data closely, assessing the possibility of a hike. Without any official statements from the Fed, the market maintained the expectation that the Fed will keep interest rates untouched at the next meeting. With these labour data in place, the rate hike suddenly became more probable to happen.

The Philadelphia Fed’s general activity index figure reported a lower negative figure, -10.4 this month, from -31.3 in April showing signs of improvement. Manufacturers were pessimistic about business conditions in the next six months, however, they planned to increase employment over that period.

The USD in general had gained a lot of ground due to these labour data figures and business activity indicators. U.S. stocks have been climbing for days. All these stopped when finally a scheduled panel discussion took place on Friday, 19th of May, at a central bank conference in Washington, with Federal Reserve Chairman Jerome Powell saying that to control inflation it might not be required to raise rates aggressively.

“…our policy rate may not need to rise as much as it would have otherwise to achieve our goals,” he added. “Of course, the extent of that is highly uncertain.”, Powell said.

The market reacted with USD depreciation during his speech. U.S. stocks dropped.

U.K. Economy

U.K.’s Labour market data figures the previous week showed that unemployment increased by more than expected, by 3.90% in the three months to March. In addition, the U.K.’s Claimant Count Change (change in the number of people claiming unemployment benefits) was reported higher and more than expected, 46.7K versus the previous 28.2K figure.

This weak, labour market data had caused the market to react with GBP depreciation at that time as expectations formed that the Bank of England may change policy and consider pausing rate hikes. Inflation though is monitored closely and its two-digit figure makes it highly unlikely that the central bank will pause rate increases soon.

Australia Economy

Weak employment data for Australia were released the previous week, causing the AUD to depreciate against other currencies. It brought down major pairs with AUD as the base currency, such as AUDUSD, experiencing a nearly 30 pips drop before retracing. Australia’s headline Employment Change report showed a surprise figure of -4.3K in April versus 25K expected and the previous 53K figure, whereas the Unemployment Rate jumped higher, to 3.7% from the previous 3.5%.

The policymakers might take this as a signal that their last surprise rate hike to 3.85% was enough and now they consider a pause next month.

The Wage Price Index q/q figure was released as well. The seasonally adjusted WPI rose 0.8% this quarter and 3.7% over the year.

Source:

https://www.reuters.com/world/uk/uk-jobless-rate-rises-39-q1-2023-05-16/

https://www.reuters.com/markets/us/new-york-factory-activity-slumps-may-ny-fed-2023-05-15/

https://www.reuters.com/markets/us/us-weekly-jobless-claims-fall-more-than-expected-2023-05-18/

_____________________________________________________________________________________________

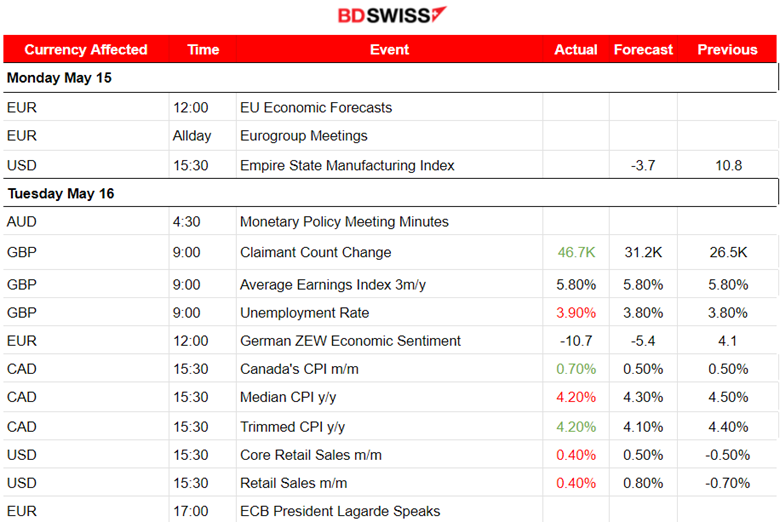

Currency Markets Impact – Past Releases (15-19 May 2023)

- The U.S. Empire State Manufacturing Index figure was reported lower than expected on the 15th of May with a low impact on the USD, causing its depreciation at that time.

- On the 16th of May, the RBA Minutes of the Reserve Bank of Australia’s May 2 policy meeting were released having no significant impact on the AUD.

- News at 5:00 regarding China’s retail sales and unemployment rate caused the AUD to depreciate but not significantly.

- The U.K.’s important labour market figures were released on the 16th, including the average earnings index (3-month moving average compared to the same period a year earlier) and unemployment rate (for the past 3 months). The unemployment rate was reported higher. The U.K.’s Claimant Count Change (change in the number of people claiming unemployment benefits) was reported much higher and more than expected. These reports caused GBP high depreciation.

- The same day, important inflation figure releases for Canada took place causing intraday shocks as CAD appreciated much from the higher-than-expected figures.

- On the 17th of May, Australia’s Wage price index figure was released and was lower than expected. The AUD was affected but not much.

- No significant impact from the release of the Final CPI figures for the Eurozone. As expected.

- This week, the Crude oil (WTI) inventory figures were released positive and, in fact, a change of 5M, which was more than the previous 3M change. The market did not react much to the news at that time, with just 70 cents of downward movement before reversing. Oil moved significantly upwards eventually.

- Australia’s Employment Change and Unemployment Rate announcements were released on the 18th of May. Employment change turned out negative while the unemployment rate rose unexpectedly. AUD suffered depreciation.

- The U.S. Unemployment Claims figure was released that day and caused an intraday shock for USD pairs as USD appreciated greatly.

- The retail sales data for Canada were released on the 19th of May. The impact on the CAD was not great.

- At 18:00, Federal Reserve Chairman Jerome Powell stated at a conference in Washington: “To control inflation it might not be required to raise hikes aggressively”. USD pairs were affected highly after the event began. The market experienced USD depreciation.

_____________________________________________________________________________________________

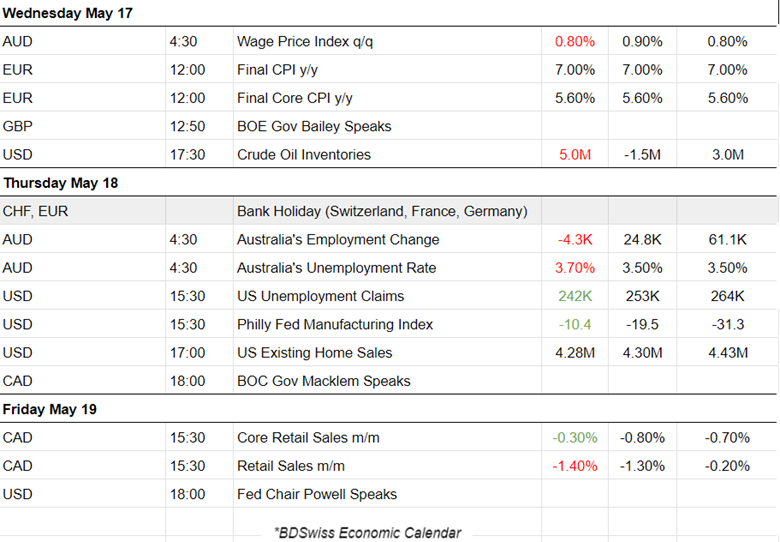

Summary Total Moves – Winners vs Losers (Week 08-12 May 2023)

The previous week, AUDJPY reached the top with a 1.80% change, followed by USDJPY with a 1.72% change. AUDJPY is leading gainers this month with a 1.93% overall price change. Silver lost the most with -a 5.27% price change this month so far.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD was on a downward trend with the main driver of this path being the USD. Recent Inflation figures caused expectations to shift from a future rate hike pause to continuation from the Fed. USD appreciated for days steadily against EUR during the week. The pair found support at 1.07600 on the 18th of May and, after testing it on the 19th of May, it eventually reverted back. It crossed the 30-period MA moving further upwards signalling the end of the downward trend. Now the market waits for news regarding the U.S. debt deal and FOMC the following week.

DXY (US Dollar Index)

During the previous week, the dollar has appreciated significantly overall, against other currencies. Recent figure releases related to CPI monthly increases pushed it higher. In addition, labour data showed that the labour market is still strong despite rate hikes. During the week, new expectations were formed about the Fed’s decision to pause suggesting that policymakers might eventually continue with the interest rate increases. However, Federal Reserve Chairman Jerome Powel said on Friday, 19th of May, at a conference that further increases might not be necessary for the Fed to achieve its goals, thus giving the impression that a pause will eventually take place, causing the dollar to drop during that time.

_____________________________________________________________________________________________

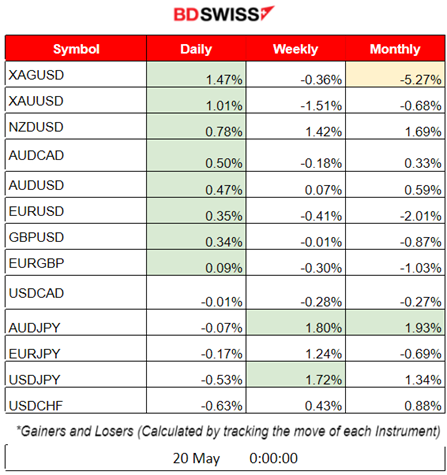

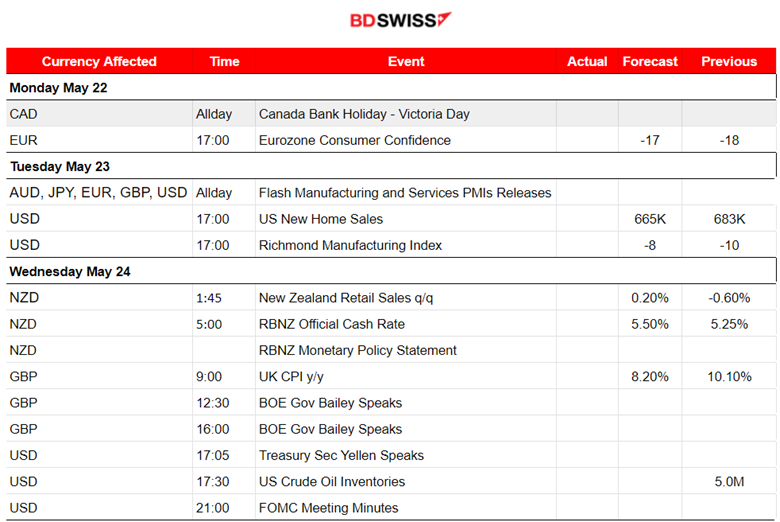

NEXT WEEK’S EVENTS (22-26 May 2023)

This week, we have PMI releases for both the Manufacturing and the Services sector taking place on the 23rd of May. For the U.S. it will be considered as critical information related to business activity that the Fed closely monitors in order to discuss before the FOMC. In addition, it will play a role in their decision on rates.

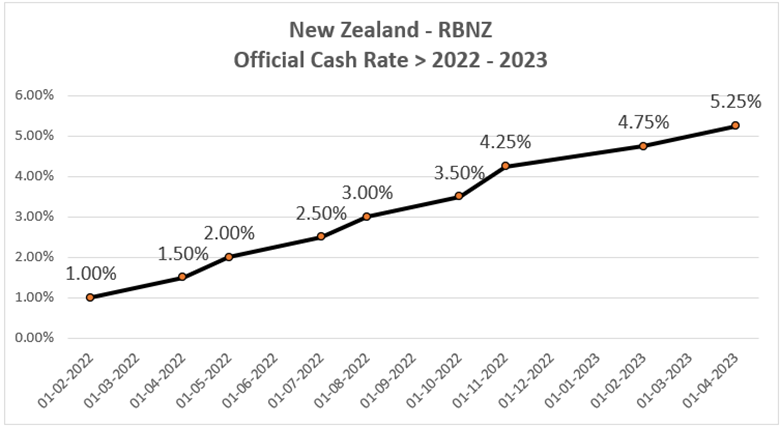

The Reserve Bank of New Zealand (RBNZ) is deciding if they will increase rates on the 24th of May, Wednesday. The market expects a rate hike by 25 basis points – an increase of 5.50%.

U.K.’s CPI data is going to be released on the 24th of May. Economists expect U.K.’s inflation to drop to 8.20%. After the release, two scheduled speeches for the Bank of England’s governor Bailey are taking place during the day.

The Secretary of the U.S. Treasury, J.Yellen is due to participate in a fireside chat titled “The U.S. Economy” at the Wall Street Journal’s CEO Council Summit. Talks will take place as June 1st approaches and if there are hot statements regarding the U.S. debt, it could cause market turmoil ahead of FOMC.

Currency Markets Impact:

- The Consumer Confidence index figure for the Eurozone is going to be released on the 22nd of May at 17:00 and is expected to show that it is actually improving. No major impact is expected for EUR.

- Flash Manufacturing and Services PMIs will cause high volatility. Pairs move highly during the European Session and shocks are expected to take place at the time of important scheduled releases such as the PMIs at 10:15 and 10:30 for the Eurozone and the U.K. PMIs at 11:30.

- U.S. PMI figures are reported after the NYSE opening at 16:45 and probably will create an intraday shock for USD pairs.

- The RBNZ will decide on interest rates on the 24th of May during the Asian Session and it will probably have a significant impact on the NZD pairs at that time.

- GBP is expected to be affected greatly at 9:00 while inflation data for the U.K. will be coming out. A surprise will probably cause a huge impact with GBP pairs to deviate greatly.

- The BOE governor will comment on inflation later on during the day and it might add to the GBP path deviating more from the mean or causing retracements to take place.

- The market will have eyes for FOMC meeting minutes as well. Any strong report will create an intraday shock. That would be more probable if not much activity for the USD takes place during the trading day.

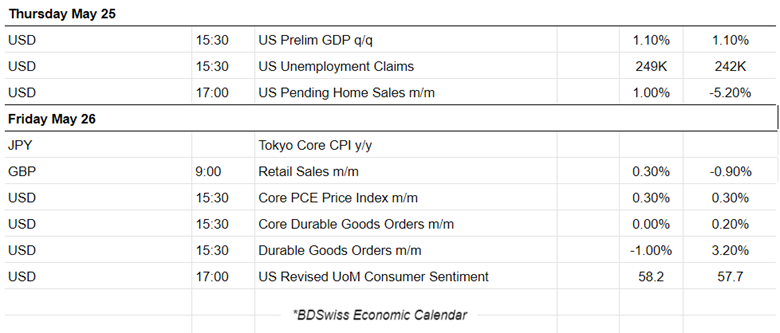

- Labour data and preliminary GDP data releases for the U.S. on the 25th of May will have an impact on the USD pairs, possibly with intraday shock at that time, 15:30. At the same time on the 26th of May, the durable goods data will be reported and will have probably a similar impact but not so great.

_____________________________________________________________________________________________

Reserve Bank of New Zealand – Official Cash Rate

The RBNZ is expected to raise rates for the 12th time in the coming week. The previous decision involved a surprise with a 50 basis point hike in April, increasing the rate to 5.25%.

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude has been moving with high volatility slightly upwards without forming a solid trend. The RSI began to show lower highs while the price formed higher highs. A bearish divergence. On Friday, 19th of May, oil eventually dropped from its peak but also crossed the 30-period MA, moving further downwards confirming a strong reversal. After finding significant support it retraced back to the mean. There seems to be no clear direction, only high deviations from the mean during the trading day followed by reversals/retracements.

Gold (XAUUSD)

Gold has been experiencing a downward trend recently as the USD was gaining ground the whole week and investors preferred more risky assets such as stocks. Gold was already in the oversold territory and, as we said in the previous daily analysis, retracement is almost inevitable. On Friday, 19th of May, Gold moved upwards, crossing the 30-period MA signalling the end of the downward trend. The USD experienced a strong depreciation as talks regarding a rate hike pause are confirming expectations. Debt-ceiling is also an issue that is still to be solved.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The index continued the movement upwards this week surprisingly with an exponential increase rate. However, on Friday 19th May it found strong resistance. The increase was explained mainly because investors have dropped safe-haven assets and are moving towards more risky assets such as stocks. A possible pause in rate hikes, strong labour data releases and debt-ceiling talks played their part in this. The market eventually found resistance and retraced on Friday.

______________________________________________________________