Weekly Outlook

U.S. Expecting Debt-Ceiling Rise, USD Stronger, U.S. Consumer Sentiment Drops, Lower Energy Prices, Metals Lower

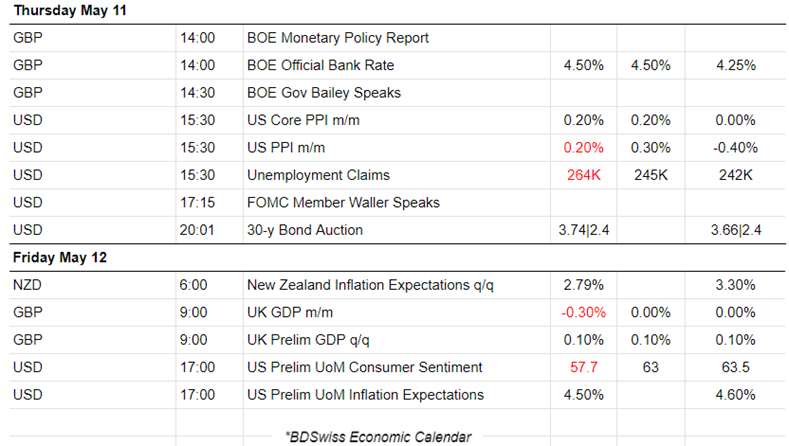

PREVIOUS WEEK’S EVENTS (Week 08-12 May 2023)

Announcements:

U.S. Economy:

Janet Yellen warned last week that if no action is taken to raise the debt ceiling the consequences will be catastrophic. The U.S. government could start running out of money within weeks unless it allows itself to borrow more. The U.S. could default on its debt and the market has not reacted significantly so far.

Talks on the issue are currently taking place with no agreement yet to be reached. President Joe Biden insists that Congress has a constitutional duty to raise the debt ceiling.

Last Tuesday, U.S. President Joe Biden and top Republicans and Democrats from Congress gathered at the White House to discuss the debt ceiling and spending. Discussions ended with no consensus on how to end their impasse over the federal debt and spending, just weeks before the nation is set to default on its debt for the first time. The house speaker Mr McCarthy raised the argument that spending limits should be imposed.

Other meetings took place after that with no final and official result. USD appreciates in the last few days as a reaction to the current market conditions of possible future recession and rising inflation expectations.

Jobless claims figures showed a significant increase. The data suggest further cooling of the Labour market, giving the Federal Reserve room to halt further interest rate increases. So far, the reports regarding inflation expectations, the Labour market and rate hikes were seen as consistent with most economists’ expectations of a recession in Q4.

We might see further hikes and no pause since the PCE inflation is stable at too-strong levels.

Michigan Consumer Sentiment Index (MCSI), preliminary, was reported at 57.7 for May versus the expected figure of 63.0. This is a widely-followed economic indicator that measures the overall level of consumer confidence and optimism in the United States, focusing specifically on the state of Michigan. Soured consumer sentiment and accelerated inflation expectations were reported on Friday reflecting growing concerns about the economic outlook.

Consumers expect rising prices at an annual rate of 3.2% over the next five to 10 years and anticipate higher costs by 4.5% over the next year.

Current incoming macroeconomic data show no critical sign of recession though.

U.K. Economy

The monthly change in GDP figure suggests that it has fallen by 0.3% in March 2023, after showing no growth in the previous month. According to output data, U.K.’s economy declined sharply in March, after growing by 0.1% in the first three months of the year. The services sector fell by 0.5% in March 2023, after an unrevised fall of 0.1% in February 2023 which was the main contributor to the fall in monthly GDP.

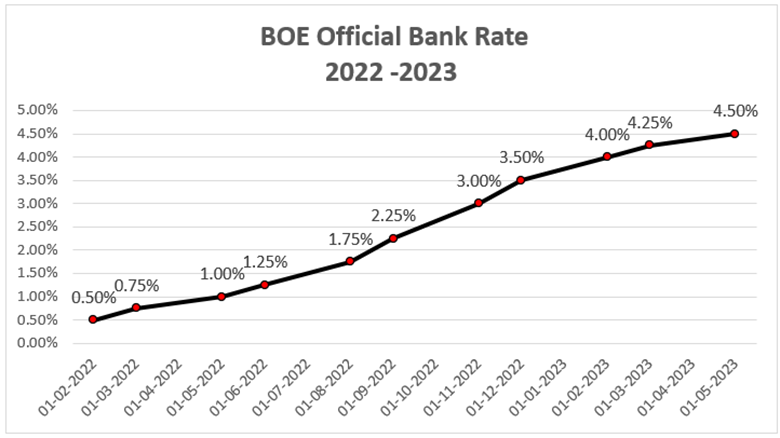

The Bank of England raised its main interest rate last week to 4.5% the highest since 2008 and forecasts that the economy will grow 0.25% in 2023.

Source:

https://www.nytimes.com/live/2023/05/09/us/debt-ceiling-biden-mccarthy

https://www.reuters.com/world/uk/uk-economy-shows-01-growth-first-quarter-2023-ons-2023-05-12/

_____________________________________________________________________________________________

Inflation and Interest Rates

U.S.:

The U.S. annual consumer price growth fell below 5%. It slowed down in April for the first time in two years, supporting the idea for the central bank to pause further interest rate hikes next month. The U.S. central bank raised its benchmark overnight interest rate by another 25 basis points to the 5.00% – 5.25% range last week and declared that it will probably pause hikes. The Consumer Inflation report does not support any near-term rate cuts though. The Consumer Price Index (CPI) rose by 0.4% last month after gaining 0.1% in March and being in line with expectations. Inflation remains strong and way above target.

“Inflation is still too high and it is not going to fall back to 2% if it increases 0.4% per month,” said Chris Low, chief economist at FHN Financial in New York. “We need to see steady increases around 0.15% to get there.”

Risks of a recession have increased, because of the Fed’s rate hikes, tightening credit conditions and recent discussions for raising the debt ceiling.

The U.S. PPI figures were released showing that the U.S. producer prices experienced a small annual increase. The monthly PPI was 0.20%, lower than expected, as per the Labour Department. However, inflation is rising even though the apparent diminishing rate and the USD appreciated greatly during the day of the release.

U.K.:

As expected, The Bank of England (BOE) decided to raise the key interest rate to 4.5% on Thursday and the market did not react too much at that time. Maybe market participants were expecting a surprise that eventually did not take place. A higher increase would make sense since inflation remains sticky and extremely high while the labour market is hot.

“We have to stay the course to make sure inflation falls all the way back to the 2% target,” Bailey said.

Inflation remained above 10% in March as the U.K. experienced unexpectedly big and persistent prices together with stronger wage growth.

Energy prices have fallen and the central bank expects inflation to drop to 5.1% by the end of this year from 10.1% in March.

Source:

https://www.reuters.com/markets/us/us-producer-prices-increase-moderately-april-2023-05-11/

https://www.reuters.com/world/uk/bank-england-raises-rates-45-inflation-slow-fall-2023-05-11/

https://www.reuters.com/markets/us/us-consumer-prices-increase-solidly-april-2023-05-10/

_____________________________________________________________________________________________

Energy:

Crude Oil has experienced unexpected volatility recently with lower and lower prices overall. However, there was a strong retracement since the 5th of May with rising prices. The U.S. inventory figures showed lower and lower negative decreases in the past weeks as more oil was demanded finding resistance at 73.8 USD. During the last few days, oil has shown a decline again near the 70 USD level.

Last week, Russia’s Energy Ministry said that the nation’s oil-output cuts almost reached the targeted level in April. Cuts were announced in March causing a shock in the market, expecting the effects to take place during May. Yet, crude flows from ports do not show any strong evidence of output cuts so far.

According to Bloomberg, Russia’s four-week average seaborne shipments rose to the highest in the period until May 5th.

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (08-12 May 2023)

- The EUR was hardly affected by the Bank Holiday in France on the 8th of May. The U.S. could default on its debt, warns Treasury Secretary Janet Yellen with catastrophic consequences. The market did not react yet to this news heavily expecting to see more development.

- The UK’s Halifax HPI M/M figure and report released on the 9th of May indicated that the U.K. house prices fell for the first time this year, as mortgage rates rose.

- The CPI changes, Inflation figures for the U.S., came out on the 10th of May and caused intraday shocks to USD pairs (USD depreciation) and other assets, such as stocks and metals. A retracement happened to all affected assets, with some experiencing nearly 100% retracement. Meanwhile, the USD depreciated at the time of the release of a lower-than-expected yearly inflation figure and appreciated later on.

- Crude Oil inventories showed a 3M positive change, breaking the series of negative changes since early April.

- BOE announced its rate decision and monetary policy on the 11th of May. The central bank decided to increase the OBR to 4.5% as expected. No surprise here. The GBP pairs experienced a small intraday shock at that time with no significant volatility.

- The U.S. PPI reports were released showing that inflation fell to 2.3% in April. It still shows signs of an increase, just less though.

- U.S. unemployment claims were actually reported a lot higher than expected. USD experienced a small intraday shock and later moved steadily upwards with appreciation against major pairs.

- New Zealand’s expectations for inflation one and two years ahead decreased to 4.28% and 2.79% respectively. This release on the 12th of May did not have much impact on NZD.

- The GDP report showed a negative monthly change for the U.K.’s GDP that was estimated to have fallen by 0.3% in March 2023. There was no significant effect on the GBP pairs.

- The U.S. Preliminary UoM U.S. Consumer Sentiment figure showed a 57.7 level, much lower than the previous one. The Long-Term Inflation Expectations hit 12-Year High reflecting growing concerns about the economic outlook. The USD appreciated significantly and steadily during the trading day, Friday, the 12th of May.

_____________________________________________________________________________________________

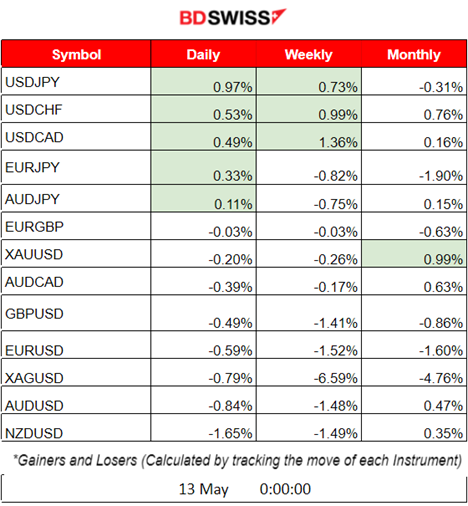

Summary Total Moves – Winners vs Losers (Week 08-12 May 2023)

The week ends with USDCAD, USDCHF and USDJPY leading, indicating that the USD was the main driver of the upside.

The month found Gold at the top with a 0.99% gain, while silver was the biggest loser with -a 4.76% change.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD experienced a significant drop starting from the 11th of May with the main driver of this path being the USD. The daily charts show that it has been a while since the pair found significant resistance near 1.10800 and after several tests with no break, it finally started a retracement path. Inflation figures on the 10th caused an intraday depreciation of the USD, however on the next day the USD started to steadily gain ground again. The USD eventually appreciated against a basket of currencies until the next week and the EURUSD was eventually pushed more on the downside.

GBPUSD

The pair was moving around the 30-period MA at the start of the week, however, it experienced a rapid downward movement starting from the 11th of May and being initiated as soon as the European Markets opened. The downward path below the MA lasted until the end of the week and the main driver was the USD. The BOE rate decision had not much of an impact on the day of the release since the decision was already priced-in and on this weekly path.

DXY (US Dollar Index)

The dollar has moved overall higher during the previous week. There are no signs of a significant trend since it moves around the 30-period MA most of the time. Recent figure releases regarding inflation and the rate hike from the Fed have pushed it higher. At the time of the US CPI figures’ release during the week, the USD depreciated and the DXY dropped at the time. During the next few days, however, it started to move significantly upwards as the market expected surprises regarding future rate hikes from the Fed and possibly a revised policy.

_____________________________________________________________________________________________

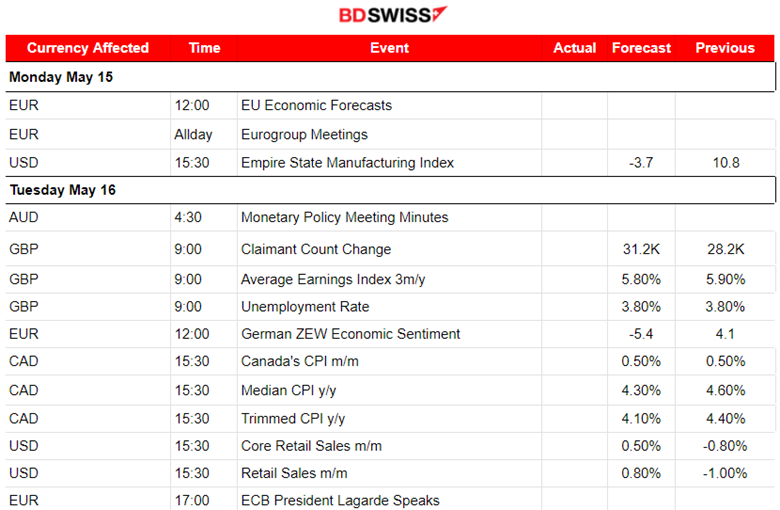

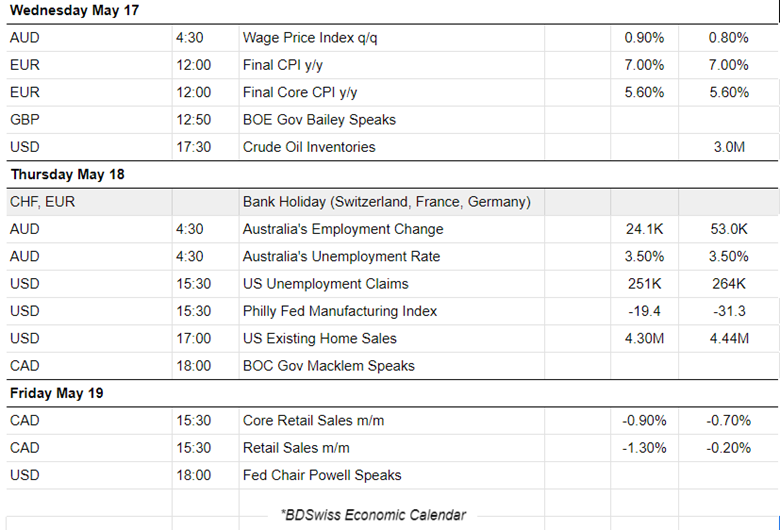

NEXT WEEK’S EVENTS (15-19 May 2023)

This week, we have the release of labour data for many regions. The U.K., Australia and the U.S.

Other important releases involve inflation figures for Canada and retail sales for Canada and the U.S.

Volatility is expected to be beyond the typical, especially for the USD and CAD. The GBP will also be greatly affected.

Currency Markets Impact:

- Eurogroup Meetings and other EUR-related events might cause an impact on EUR. It recently started to show that it is moving more on the downside. We are expecting that it will show a short-term steady movement in one direction as news are being released. No shocks but steady trends.

- The Empire State Manufacturing Index is taken into consideration greatly by the market participants and probably will cause a small intraday shock for USD pairs.

- The U.K. Claimant Count Change figure, the change in the number of people claiming unemployment-related benefits during the previous month, will cause an intraday shock for GBP pairs as it gives important insights for the labour market and a higher figure is expected in line with the expected market cooling. We often see surprises with such figures though.

- Canada’s CPI data are expected to cause an intraday shock for CAD pairs while U.S. retail sales will affect the USD. Not expecting a large shock there.

- Australia’s Wage Price Index q/q figure is marked as important. A small intraday shock is expected for AUD pairs.

- On the 18th of May, Australia’s Labor data are important and a big intraday shock will probably take place affecting AUD pairs.

- The U.S. Unemployment Claims figure will have an effect on the USD and we are expecting a slight shock. Depending on the Philly Fed Manufacturing Index figure size and direction, the shock might be of a higher level.

- On the 19th of May, the retail sales figures will cause a small intraday shock for CAD pairs.

_____________________________________________________________________________________________

BOE Official Bank Rate

U.K.’s inflation rate remains too high even though rates have been increasing following similar U.S. and Eurozone policy decisions. With the recent BOE decision the OBR was raised as expected to 4.50%.

_____________________________________________________________________________________________

U.S. Consumer Price Index Change (Inflation)

The Fed has significantly reduced the inflation rate with its aggressive rate hike campaign. The target level is at 2% while the Fed stated that hikes will pause for now. The yearly figure was last reported at 4.9%. However, there is a possibility that the Fed will continue with its aggressive policy and the USD has already experienced appreciation against major pairs.

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude’s price started to move downwards on the 11th of May crossing the 30-period MA, breaking important support levels (part of a triangle formation) and staying lower for the rest of the week as USD appreciated. On the technical analysis side, the RSI signals bullish divergence since it formed higher lows while the price formed lower lows. Considering the daily volatility, a reversal to the upside is possible.

Gold (XAUUSD)

Gold moved to lower levels below the 30-period MA. USD appreciation and future higher inflation expectations are creating turmoil in the market. It has, however, shown resilience in dropping much while Silver (XAGUSD) did not. Silver experienced a rather high drop with more negative price change than -4% this month.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The index climbed higher this week. Fed’s statement for a potential pause in rate hikes enhances the risk-on mood but the latest monthly growing inflation-related figures have affected investor decisions. Pause in rate hikes might not take place, USD appreciated and stocks moved lower. On Friday the market fell after finding intraday resistance and this downward movement was in line with our expectation of a decline based on the technicals. Bearish divergence was formed as per the chart below: RSI with lower highs, Price with higher highs.

______________________________________________________________