Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 18.10.2024

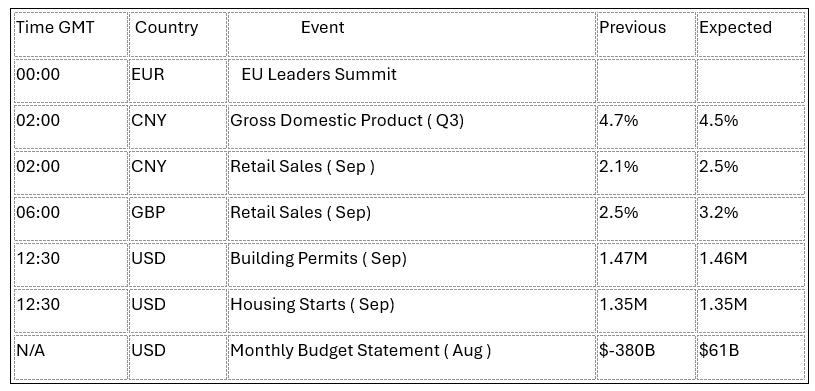

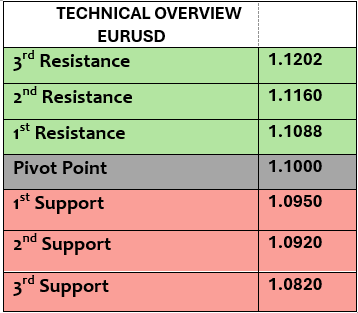

EURUSD: As highly expected , ECB cut the rates by 0.25% on Thursday, this decision was unanimous according to ECB President Lagarde. Interest rate in EZ is at 3.25% , the lowest since May 2023. ECB clarified that the monetary policy would remain data-dependent. EURUSD traded slightly higher today at $1.0841, not far from the lowest level since early August 2024. Inflation in EZ contracted by -0.1% MoM in September, matching the estimates.

Last major support was executed, new one added. Correction may happen & target $1.0865, but the price action is not yet fully bullish.

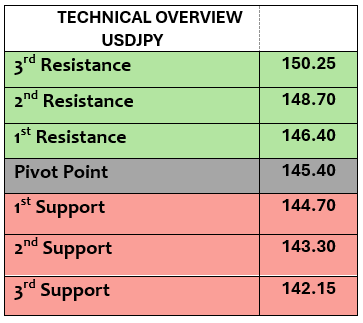

USDJPY: Eight consecutive days of the gains in USD index, it will not be a surprise if USD index starts technical correction. USDJPY traded weaker this morning at 149.81. Japan’s inflation fell to 2.5% in September, the weakest in five months. Markets are closely watching BoJ reaction to Yen weakness, not to forget the Japan’s central bank intervened before at 160 and now 150 is the highest in almost three months.

Price action is still heading higher with lower velocity, targeting the last major resistance at 150 (done yesterday) . 147.50 & 146 are important support levels. Positive channel persists.

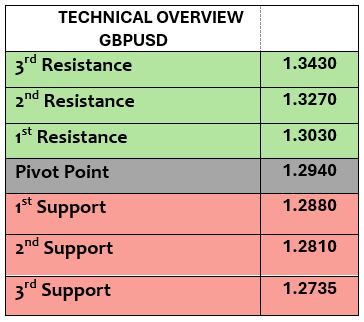

GBPUSD: GBPUSD started recovering in the last two days, will the UK retail sales save the markets’ bulls? GBPUSD traded at $1.3023 this morning, GBP benefited from EUR weakness after ECB cut the rates yesterday. In the meantime, weaker retail sales will just complicate the BoE mission & add pressure to cut the rates sooner than later.

While 1H RSI is heading higher, the next target will be $1.3075. It is correct that the trading happens above the pivot, but the velocity of the price action remains fragile.

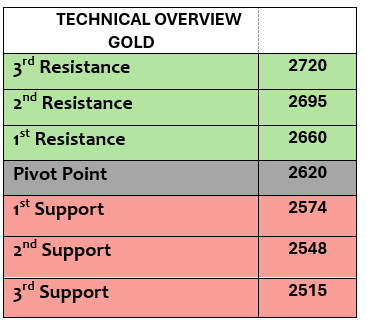

GOLD: Gold never sleeps & disappoints markets’ bulls. Gold gained and advanced today to $2711 per ounce, a new record high as momentum remained robust. China’s retail sales increased by 3.2% in September, beating the estimates, that was a bullish sign for market bulls. Traders must be aware of the aggressive volatility & possibility of technical correction.

As the chart shows, momentum remained positive, and price action is aggressive & overbought now ( 76 on RSI) . New resistance was added and the target for correction will be $2690 now.

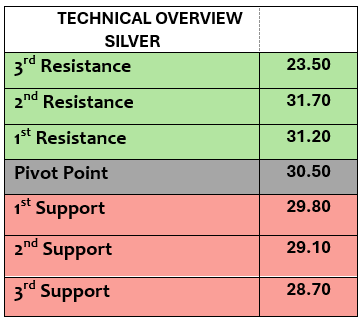

SILVER: We repeated many times before that silver heavily relies on China’s data & demand, China’s growth by 4.6% in Q3/2024 & stronger retail sales than before triggered the demand in silver today, silver gained by more than 1% & traded at $32.10 per ounce, two-week high. At the same time, China’s industrial production increased by 5.4% last month, it was another positive data to rely on.

1H price action is heading higher to the 3rd resistance after our targets were executed. Technical correction to $31.30 is possible. Technical diagram still favors bullish bets.

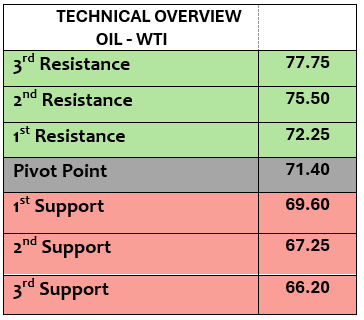

OIL-WTI: US crude oil inventories fell by -2.1 million barrels last week according to EIA after it increased by 5.8 million barrels two weeks before, that’s why oil prices traded slightly higher today, WTI $70.97PB, Brent $74.65PB. China’s GDP grew by 4.6% in Q3, slightly beating the estimates, good news for oil traders as China remains World’s second biggest oil consumer & biggest oil importer, however it is still early to talk about full recovery in oil prices after WTI lost -6% in a week.

$69.90 is support for day-traders,. Price action remained bearish as the traders’ behavior showed. Correction to $72 may happen as 1H RSI is slowly increasing.

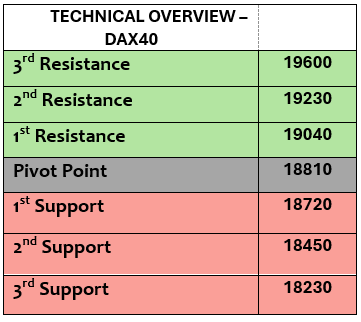

DAX: DAX index increased by 0.8% on Thursday, closed at record high 19584 after ECB lowered the borrowing costs by 0.25% , high risk assets gained. DAX futures traded slightly weaker this morning. Yesterday, Airbus gained 3.9%, Merck 7.5% & Siemens energy 4.2%. We keep an eye on EU leaders summit for any update in economics & politics.

Momentum indicator remains positive, supported by price action & bullish behavior. Heading higher to the last major resistance in 19600 is highly probable while technical correction will be at 19400.

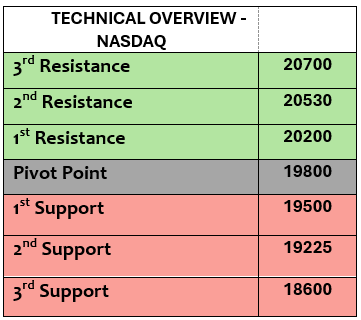

NASDAQ: US stock indexes were mixed yesterday, Dow Jones gained 0.37% to another record high, SPX was lower by 0.02% & Nasdaq was up by only 0.04%, US stock futures were mixed as well amid tight trading this morning. Netflix gained 5% on better-than-expected earnings in Q3. US retail sales increased by 0.4% in September, which was better than before, and the weekly initial jobless claims fell to 241K from 260K. US housing starts & building permits will be due later today. Remember that as long as US economy is doing well, demand for USD will remain intact.

Technical correction started from 20500 , the next support will be at 19750 , however the price action is not yet fully bearish. Higher volatility ahead.

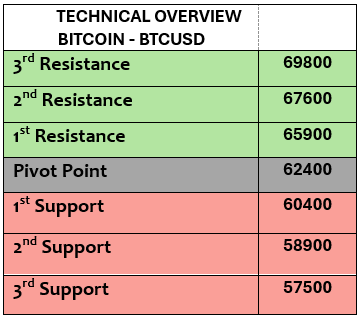

Bitcoin: BTCUSD advanced by 1% & traded higher today at $67957, Eth $2627, and Solana gained 1% to $153.02 . Crypto assets followed the same bullish attitude other high-risk equities did in the last few days, at the same time, Trump’s trade is gaining momentum again, very hard to ignore this fact. Crypto market cap increased again to $2.3 trillion.

Higher volatility will continue, so beware of the aggressive correction ( if happens ) that may target $62500 & $61700 . Price action is still supporting further advance to $68400 which is likely today.