Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 20.11.2024

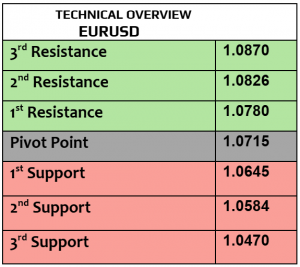

EURUSD

Amid tight volatility, EURUSD traded lower this morning at $1.0592 as the escalation of the war between Russia & Ukraine remained the most risky factor economically & politically. Inflation in EZ remained unchanged in October at 2%, matching the target of ECB. ECB will release the financial stability review later today; this report is published twice a year. ECB’s president Lagarde will deliver speech later today as well. Sentiments from EZ remained cautious & anxious.

$1.0590 remained short-lived resistance then $1.0635, but price action showed no bullish bets. The correction in USD index may trigger further but slow correction to higher level.

USDJPY

Both, exports & imports from Japan improved in October, opening the dialogue again about the rate hikes by BoJ, USDJPY traded higher today at 155.03. BoJ governor said on Monday that any future rate hikes would be gradual, such a statement was highly expected. Keep an eye on the geopolitical tensions in EZ, remember that Yen is a safe-haven currency.

Price action resumed the uptrend, targeting 155.60. 154.10 is support then 153.50. This currency pair might be exposed to BoJ intervention if Yen weakness persists.

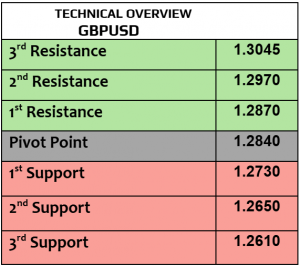

GBPUSD

Will the UK inflation change the forward guidance of BoE? The forecasts indicated to higher CPI in October than September, which means that the UK is literally living the stagflation. GBPUSD was little changed today at $1.2687, the lowest level since mid-May. PPI & retail price index from the UK will be due later today. Higher retail prices will complicate BoE mission to cut the rates, simply because UK inflation remained very sticky & elevated.

$1.2624 & $1.26 are support levels, $1.2750 is resistance. While the behavior of the traders was not fully bearish, heading higher is likely to be slow.

Gold

After two consecutive days of bullish performance, gold traded unchanged today at $2637 per ounce, the highest in ten days. Gold benefited from the falling US bond yields (correction) and rising tensions in EU after Ukraine launched its first attack on Russian soil with US missiles. In the meantime, the focus will remain more on US rate cuts & Trump’s new policies.

Price action kept recovering, heading higher to $2612/$2620 (both targets are executed) then $2658. $2560 & $2540 are important support, if broken then no major support before $2510.

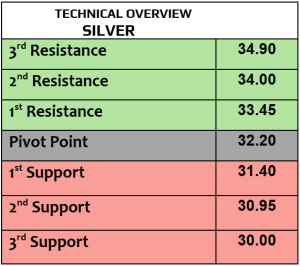

Silver

Silver slightly fell today & traded at $31.14 per ounce after PBoC kept the interest rate unchanged at 3.1%. The improvement (if happens) of manufacturing PMI numbers later this week could have bullish impact on the demand outlook. In the meantime, silver is likely to remain correlated to the performance of gold & correction in USD index (if any).

$30.20 and $29.75 are support levels, $31 remains short-term resistance (executed) then $31.75. Volatility is low.

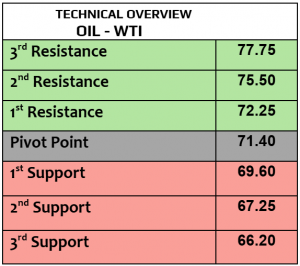

Oil – WTI

Mixed sentiments persisted in oil markets between higher US crude oil inventories (bearish on prices) and rising tensions between Russia & Ukraine (bullish on prices). According to API, US crude oil inventories increased by 4.7 million barrels last week, exceeding the markets’ expectations of 0.8 million barrels. Crude oil prices slightly fell today, WTI $69.21PB, Brent $73.24PB, both oil benchmarks are up by 1.2% in a week. Keep an eye on EIA weekly crude oil inventories later today.

Price action increased, $70.50 is the next target. $67.60 & $66.90 are important support.

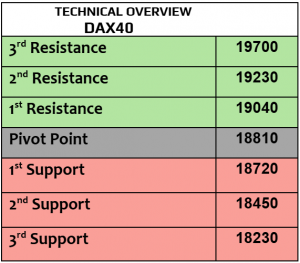

DAX

DAX futures traded higher today at 19100 after it fell by almost -1% on Tuesday due to escalation of the war between Russia & Ukraine. Siemens fell by -3.3% followed by -1.2% in Mercedes, -2% in Porsche & -2% in Continental. PPI from Germany will be due later today, it was contracted by -0.5% in September. Major EZ stock indexes dropped yesterday in France, Italy & Spain.

Price action and markets’ sentiments were somehow mixed. 18900 is support (executed) then 18700 (still valid), 19290 is resistance.

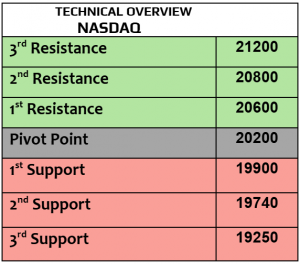

Nasdaq

US stock futures traded higher today, ignoring the worst-case scenario that may happen later which is the massive escalation of the war between Russia & Ukraine, not to forget the use of nuclear weapons as well. Dow Jones dropped yesterday by -0.28%, SPX gained 0.4% & Nasdaq rose 1% after Nvidia stock surged. There will be no major data from the US for today, that’s why the focus will remain on Fed members comments & geopolitical developments.

Price action kept improving, heading higher to 20750. 20400 & 20300 are support for day-traders. 1H RSI shows the potential for further gains (still heading higher to 70).

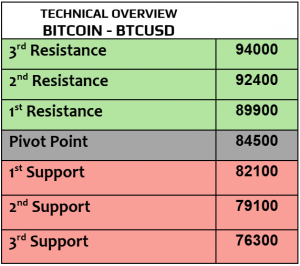

BTCUSD

There was no change in crypto markets’ bullish sentiments & rally didn’t stop as well. BTC traded higher today at $92700, still at record high. Eth $3116, Cardano $0.7884 and XRP $1.0918. BlackRock, the largest asset management in the world, officially launched iShares Bitcoin Trust ETF (IBIT) for options trading in Nasdaq. FYI, Bitcoin hit all -time high of $94K on Tuesday.

Price action showed no appetite for profit taking, still heading higher to $93K & new resistance at $94K as well. $88900 & $86500 are support. Continuous strong volatility ahead.